In recent years, several European Union (EU) countries have taken the significant step of terminating or amending their tax treaties with other nations. This trend has sparked considerable discussion among policymakers, economists, and international businesses, as these treaties have long been fundamental to cross-border economic activities. Understanding the motives behind these changes is crucial for grasping the broader implications for international trade and diplomacy.

Exploring the Motives Behind Tax Treaty Changes

The primary motivation for EU countries to reconsider their tax treaties often stems from the need to address issues of tax avoidance and evasion. In a globalized economy, multinational corporations can exploit gaps and mismatches in international tax rules to minimize their tax liabilities, often shifting profits to jurisdictions with favorable tax regimes. By amending or terminating outdated treaties, EU nations aim to close these loopholes, ensuring that companies pay their fair share of taxes within the jurisdictions where they generate economic value.

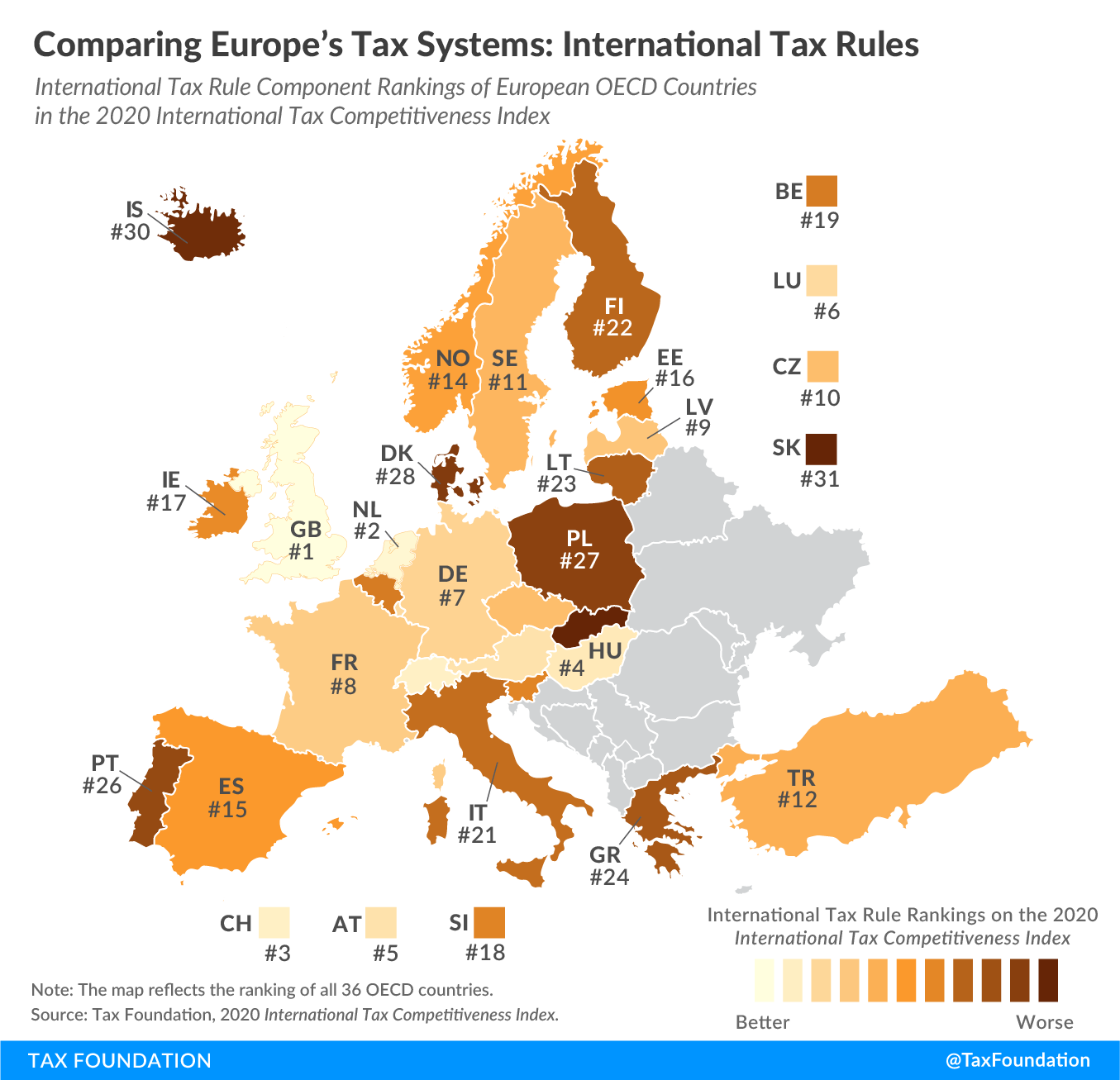

Another driving factor is the alignment with new international tax standards. The Organization for Economic Co-operation and Development (OECD) has been at the forefront of efforts to reform global tax systems through initiatives like the Base Erosion and Profit Shifting (BEPS) project. EU countries are keen to update their tax treaties to reflect these evolving standards, enhancing transparency and promoting fair competition. Amending treaties is seen as a way to facilitate compliance with international norms and prevent harmful tax practices that could undermine the integrity of national tax systems.

Additionally, political and economic shifts within the EU itself have prompted countries to reassess their fiscal agreements. The economic landscape of the EU is constantly evolving, with member states striving to balance national interests with collective EU goals. Changes in government, economic crises, or shifts in public sentiment towards taxation can influence a country’s approach to international tax treaties. For instance, populist movements advocating for greater fiscal sovereignty can lead to calls for renegotiating or terminating treaties perceived as unfavorable or inequitable.

EU Nations Reassess Fiscal Agreements

Several EU countries have already embarked on the path of treaty termination or renegotiation, each driven by unique national circumstances. For example, France and Germany have been proactive in revising their tax treaties to incorporate anti-abuse provisions, reflecting their commitment to tackling tax avoidance. These amendments often include measures such as the Principal Purpose Test (PPT), which denies treaty benefits if one of the principal purposes of a transaction is to obtain a tax advantage. Such provisions aim to ensure that tax treaties serve their intended purpose of facilitating genuine economic activity rather than being exploited for tax avoidance.

Another notable example is the Netherlands, which has historically been a hub for multinational corporations due to its favorable tax treaties. However, in recent years, the Dutch government has faced increasing pressure to reform its tax treaty network. In response, the Netherlands has initiated the process of renegotiating treaties with over 20 countries, focusing on incorporating anti-abuse clauses and aligning with OECD standards. This move is part of a broader strategy to enhance the country’s reputation as a responsible global tax player while safeguarding its economic interests.

Moreover, the European Commission has played a crucial role in encouraging member states to reassess their tax treaties. Through its Action Plan for Fair and Efficient Corporate Taxation, the Commission has emphasized the importance of updating tax treaties to prevent base erosion and profit shifting. By fostering cooperation among EU countries, the Commission aims to create a more cohesive and effective approach to international taxation. This collective effort underscores the EU’s commitment to ensuring that tax treaties are not only tools for fostering economic ties but also instruments for promoting fairness and transparency in the global tax landscape.

As EU countries continue to navigate the complex terrain of international taxation, the trend of terminating or amending tax treaties is likely to persist. While these changes may pose challenges for businesses accustomed to the status quo, they also present opportunities for creating a more equitable and transparent tax environment. By addressing issues of tax avoidance, aligning with international standards, and responding to political and economic dynamics, EU nations are taking significant steps towards a more sustainable and fair global tax system. The ongoing reassessment of tax treaties reflects a broader commitment to ensuring that tax policies meet the needs of modern economies while upholding the principles of fairness and accountability.