In recent years, several European Union (EU) countries have shown a marked preference for flat tax systems over progressive tax schemes. This shift has sparked considerable debate among economists, policymakers, and the general public. While some argue that flat taxes simplify tax codes and stimulate economic growth, others worry about potential social inequities. This article delves into the reasons behind the appeal of flat tax systems in the EU and examines the economic and political motivations driving this trend.

The Appeal of Flat Tax Systems in the EU

Advocates of flat tax systems in the EU often highlight the simplicity and transparency that such systems bring to tax administration. Unlike progressive tax systems, which require multiple tax brackets and complex calculations, flat tax systems apply a single tax rate to all taxable income. This straightforward approach reduces administrative costs and minimizes the potential for errors and tax evasion. For taxpayers, it means a clearer understanding of their tax obligations, fostering a sense of fairness and compliance.

Moreover, proponents argue that flat tax systems can enhance economic efficiency by reducing the disincentives for earning higher incomes. In progressive tax systems, individuals and businesses face higher tax rates as their income increases, which can discourage additional work or investment. Flat taxes, on the other hand, apply the same rate to all income levels, potentially encouraging productivity and growth. This can be particularly appealing to smaller EU countries looking to boost their competitiveness and attract foreign investment.

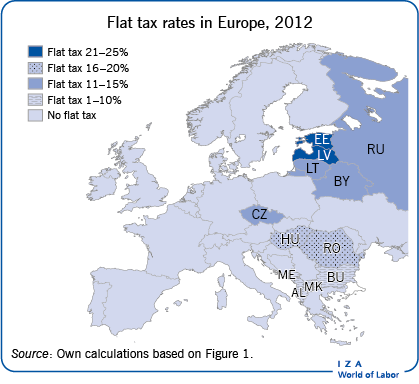

Another significant reason for the appeal of flat tax systems is their potential to stimulate economic growth and job creation. By lowering the overall tax burden, flat taxes can increase disposable income for individuals and profitability for businesses. This, in turn, can lead to higher consumer spending and increased investment in the economy. Countries like Estonia and Slovakia, which have implemented flat tax systems, have reported positive economic outcomes, including higher GDP growth rates and improved employment figures. These success stories serve as powerful examples for other EU countries considering similar reforms.

Analyzing Economic and Political Motivations

The economic motivations behind the adoption of flat tax systems often revolve around the desire to foster a more dynamic and competitive economy. In a globalized world, EU countries are constantly vying to attract businesses and skilled workers. Flat tax systems can serve as a strategic tool to create a more business-friendly environment. By offering a predictable and lower tax rate, these countries can attract foreign direct investment and encourage domestic entrepreneurs to expand their operations, ultimately driving economic growth.

Politically, the adoption of flat tax systems can be seen as a response to growing public dissatisfaction with complex and often opaque progressive tax systems. Voters in many EU countries have expressed frustration with what they perceive as an unfair tax burden, particularly on middle-income earners. Flat tax systems offer a more straightforward and seemingly equitable solution, which can be a powerful selling point for politicians seeking to gain or maintain public support. The promise of tax simplification and fairness resonates with a broad spectrum of the electorate.

Furthermore, the political landscape in some EU countries has shifted towards more market-oriented and conservative ideologies, which traditionally favor lower taxes and smaller government. Flat tax systems align well with these principles, emphasizing individual responsibility and economic freedom. By adopting flat taxes, political leaders can signal their commitment to these values, appealing to their base and differentiating themselves from opponents who advocate for more progressive tax policies. This ideological alignment can be a significant factor in the decision to implement flat tax reforms.

The preference for flat tax systems in some EU countries is driven by a combination of economic and political motivations. The simplicity and transparency of flat taxes, along with their potential to stimulate economic growth, make them an attractive option for policymakers. Additionally, the political appeal of tax fairness and alignment with market-oriented ideologies further bolsters their adoption. As the debate continues, it remains to be seen how many more EU countries will follow this path and what the long-term implications will be for economic equality and fiscal stability in the region.