In an era of increasing globalization and cross-border financial activities, transparency in tax matters has become a pivotal concern for governments worldwide. Within the European Union (EU), the exchange of tax information plays a crucial role in ensuring that member states can effectively manage tax compliance and combat tax evasion. This article delves into the intricacies of tax information exchange within the EU framework and examines its impact on European treaties, providing a comprehensive understanding of its significance in the region’s economic landscape.

Exploring Tax Information Exchange in the EU

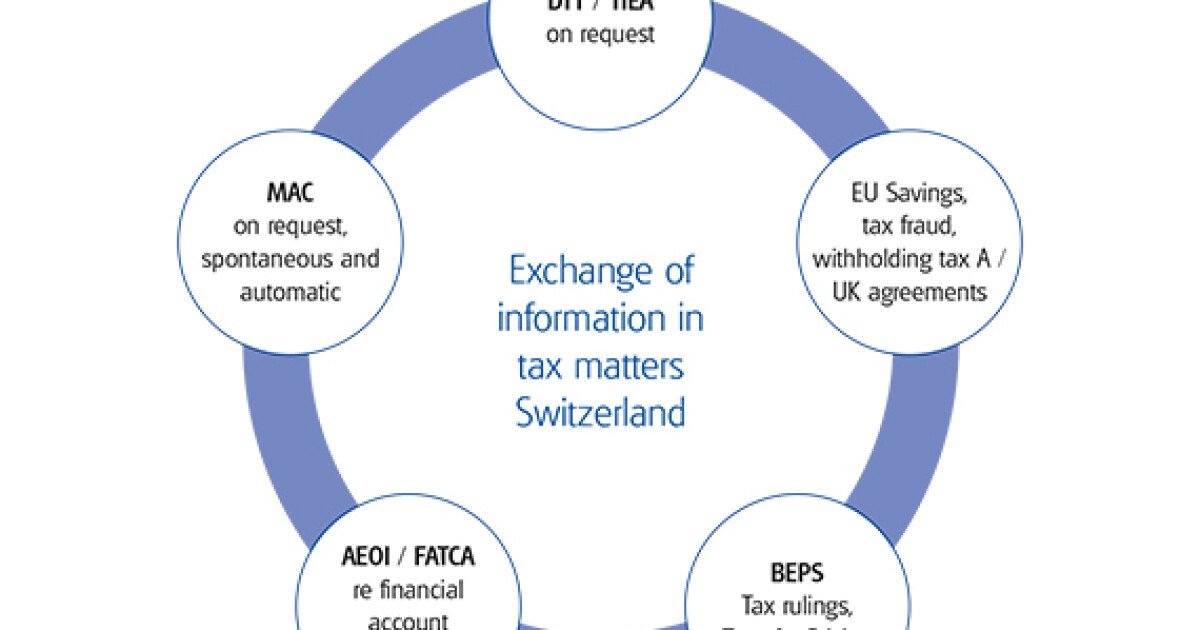

Tax information exchange within the EU is a mechanism designed to facilitate the sharing of tax-related data between member states. This system aims to combat tax evasion and ensure that individuals and corporations pay their fair share of taxes. The EU has implemented several directives and regulations to streamline the process, such as the Directive on Administrative Cooperation (DAC), which sets out specific provisions for the automatic exchange of financial account information. By fostering transparency and cooperation, these measures help prevent tax base erosion and profit shifting, ultimately promoting fair competition within the single market.

The exchange of tax information is not limited to direct taxes but also encompasses indirect taxes like VAT. Given the complexity and diversity of tax systems across the EU, ensuring compliance requires a robust framework for sharing information. The EU has established various platforms and databases, such as the Common Communication Network (CCN) and the Central Directory (CD), to facilitate this exchange. These tools enable tax authorities to access and verify information efficiently, thereby enhancing their ability to detect and address discrepancies in tax filings.

Despite the progress made, challenges remain in achieving seamless tax information exchange across the EU. Differences in national tax laws, varying levels of technological infrastructure, and concerns about data privacy and protection pose significant hurdles. Nonetheless, the EU continues to work towards harmonizing tax information exchange processes, recognizing the importance of collaboration in tackling tax evasion and ensuring fiscal stability across member states.

Analyzing Its Impact on European Treaties

The role of tax information exchange has been instrumental in shaping European treaties, particularly those related to economic governance and fiscal policy. By enhancing transparency and reducing opportunities for tax avoidance, these mechanisms contribute to the effective implementation of treaties aimed at promoting economic integration and financial stability. The EU’s efforts in this area are reflected in the strengthening of the Economic and Monetary Union (EMU) and the adoption of measures to prevent harmful tax competition among member states.

One of the key impacts of tax information exchange on European treaties is the reinforcement of mutual trust and cooperation between member states. The exchange of tax data fosters a collaborative environment where countries can work together to address tax-related challenges, thereby enhancing the effectiveness of treaties that rely on collective action. This cooperation is essential for the success of initiatives such as the EU’s Fiscal Compact, which aims to ensure fiscal discipline and sustainable public finances across the region.

Furthermore, tax information exchange plays a critical role in aligning EU treaties with global standards on tax transparency and cooperation. By adhering to international frameworks, such as the OECD’s Common Reporting Standard (CRS), the EU demonstrates its commitment to global efforts in combating tax evasion and fostering economic fairness. This alignment not only strengthens the EU’s position in international negotiations but also enhances the credibility and legitimacy of its treaties, promoting a more equitable global tax system.

In conclusion, the exchange of tax information in the EU is a vital component of the region’s strategy to enhance tax compliance and combat tax evasion. By facilitating transparency and cooperation among member states, it supports the effective implementation of European treaties and contributes to the broader goals of economic integration and financial stability. As the EU continues to address challenges and refine its approaches, the role of tax information exchange will remain central to ensuring a fair and equitable tax environment, both within the region and on the global stage.