In an increasingly globalized world, cross-border taxation has emerged as a complex issue requiring sophisticated mechanisms to manage disputes. The European Union (EU), with its diverse member states and intertwined economies, faces unique challenges in harmonizing tax policies and resolving disputes. This article delves into the role of dispute resolution in EU tax treaties, exploring the mechanisms that contribute to maintaining tax harmony across borders.

Analyzing Dispute Resolution in EU Tax Treaties

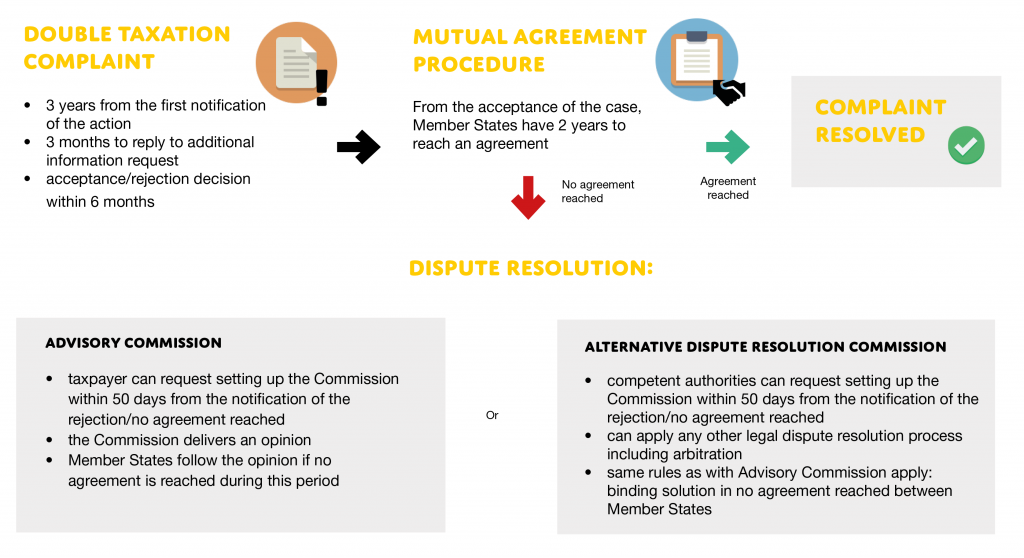

The role of dispute resolution in EU tax treaties is pivotal, as it provides a structured approach to addressing conflicts that arise from cross-border taxation. These treaties are designed to prevent double taxation and ensure fair tax distribution between member states, yet differences in interpretation and application can lead to disputes. To mitigate such conflicts, EU tax treaties incorporate specific dispute resolution mechanisms, such as mutual agreement procedures (MAPs) and arbitration clauses, which aim to ensure that issues are resolved amicably and efficiently.

Mutual Agreement Procedures are a cornerstone of dispute resolution in EU tax treaties. They involve negotiations between the competent authorities of the involved member states to reach a consensus on how to apply the treaty provisions. While MAPs are generally effective in resolving disputes, they can be time-consuming and, in some cases, fail to produce a satisfactory outcome. This has led to calls for more robust and expedited processes, prompting the EU to explore additional mechanisms to enhance the efficiency of dispute resolution.

Arbitration is another key component of dispute resolution in EU tax treaties, offering a binding solution when MAPs do not yield results. The inclusion of arbitration clauses in tax treaties provides a formalized process where an independent third party makes a final decision on the dispute. This mechanism not only ensures a resolution but also serves as a deterrent for protracted negotiations, as countries are encouraged to settle disputes internally to avoid arbitration. However, the effectiveness of arbitration depends on the willingness of member states to accept and implement the decisions made, which remains a challenge in achieving cross-border tax harmony.

Key Mechanisms Shaping Cross-Border Tax Harmony

To foster cross-border tax harmony, the EU has implemented several key mechanisms within its tax treaties. The introduction of the EU Arbitration Convention marked a significant step towards enhancing dispute resolution by establishing a uniform procedure for resolving transfer pricing disputes. This convention provides a framework for arbitration, ensuring that disputes are addressed within a fixed timeframe, thereby reducing uncertainty for businesses operating across borders.

The Base Erosion and Profit Shifting (BEPS) Action Plan, developed by the OECD and supported by the EU, further reinforces the mechanisms for dispute resolution. By promoting transparency and consistency in tax practices, the BEPS Action Plan aims to eliminate gaps and mismatches in tax rules that lead to disputes. The EU’s commitment to implementing BEPS measures reflects its dedication to creating a fair and predictable tax environment, where disputes are minimized and resolved efficiently when they arise.

Moreover, the EU’s focus on enhancing cooperation between tax authorities plays a crucial role in shaping cross-border tax harmony. Initiatives such as the EU’s Directive on Administrative Cooperation (DAC) facilitate the exchange of information and collaboration between member states. By fostering a culture of cooperation and transparency, these mechanisms help prevent disputes from arising and ensure that any conflicts are resolved swiftly, contributing to a more stable and harmonious tax landscape across the EU.

As the EU continues to navigate the complexities of cross-border taxation, the importance of effective dispute resolution cannot be overstated. By refining existing mechanisms and fostering greater cooperation among member states, the EU aims to create a more predictable and harmonious tax environment. While challenges remain, the ongoing evolution of dispute resolution in EU tax treaties is a testament to the commitment of member states to address and resolve conflicts in a fair and efficient manner, ultimately benefiting businesses and economies alike.