In the complex landscape of international taxation, arbitration clauses in EU tax treaties serve as pivotal tools for resolving cross-border tax disputes. These clauses are designed to provide a structured mechanism for addressing disagreements between countries over tax matters, ensuring that such disputes do not escalate into prolonged legal battles. With the increasing globalization of businesses and the resultant rise in cross-border transactions, understanding the role and function of these arbitration clauses has become more crucial than ever. This article delves into the intricacies of arbitration clauses in EU tax treaties, exploring their implications for cross-border tax disputes and their impact on international taxation.

Deciphering Arbitration Clauses in EU Tax Treaties

Arbitration clauses in EU tax treaties are provisions that allow disputing parties to resolve their issues through arbitration rather than litigation. These clauses are included in bilateral tax treaties to provide a clear pathway for dispute resolution, particularly when the competent authorities of the involved countries cannot reach an agreement through mutual consultation. The inclusion of arbitration clauses is intended to enhance the efficiency and effectiveness of resolving tax disputes, thereby minimizing the risk of double taxation and ensuring fair treatment of taxpayers engaged in cross-border activities.

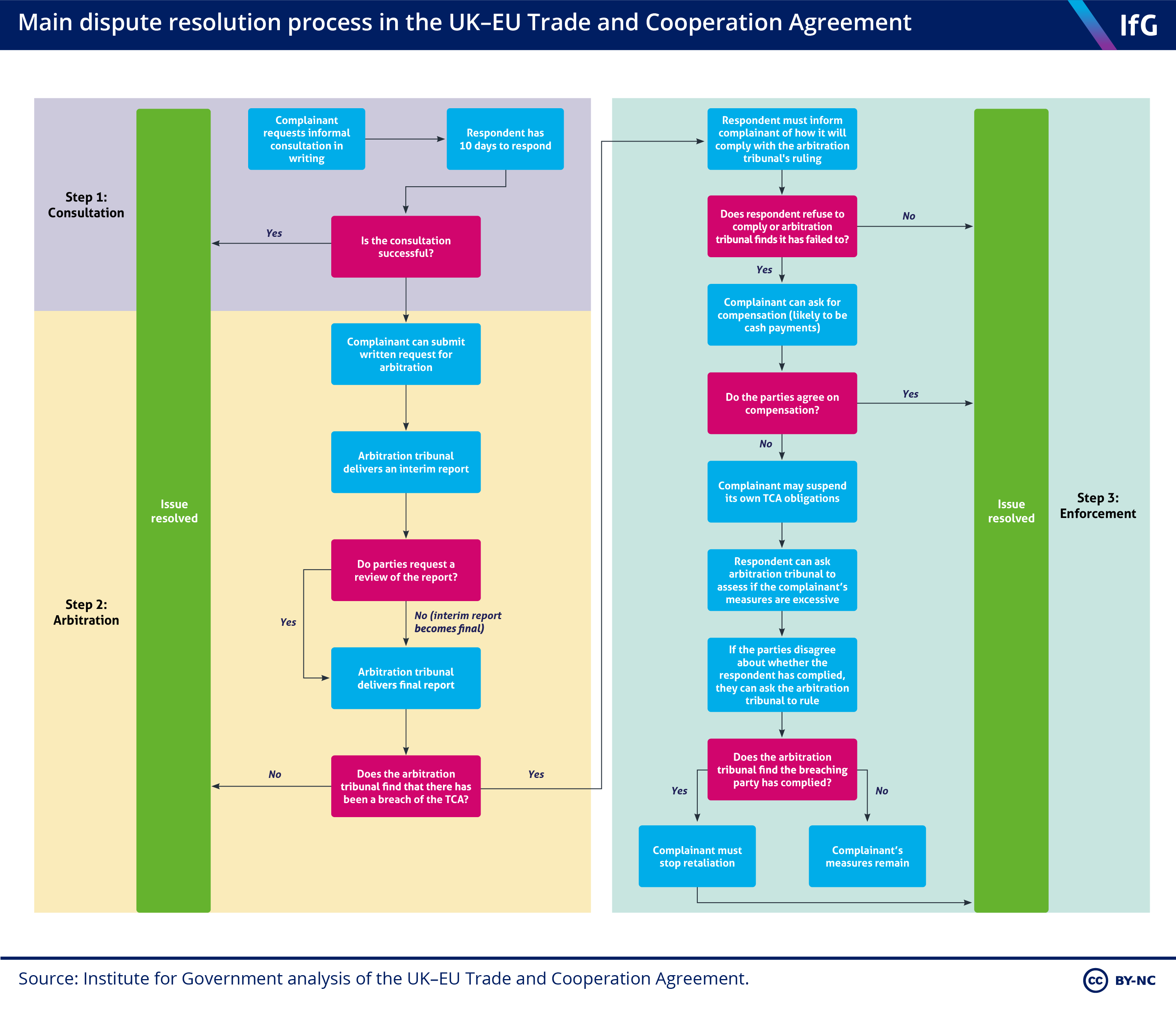

The structure of these clauses typically outlines the process and rules governing the arbitration procedure. This includes the selection of arbitrators, the timeline for proceedings, and the scope of issues that can be arbitrated. The EU has taken significant steps to standardize these clauses, notably through the introduction of the EU Arbitration Convention and the more recent Directive on Tax Dispute Resolution Mechanisms. These instruments aim to create a uniform framework for arbitration across member states, reducing inconsistencies and fostering greater legal certainty for businesses operating in multiple jurisdictions.

Despite their advantages, arbitration clauses in EU tax treaties are not without challenges. One significant issue is the potential for lengthy and costly arbitration processes, which can be a burden for smaller enterprises. Additionally, the effectiveness of arbitration is contingent upon the willingness of the involved states to adhere to the arbitral decision. Although arbitration is binding, enforcement can be problematic if a state refuses to comply with the ruling, highlighting the need for robust enforcement mechanisms within the EU framework.

Impacts and Implications for Cross-Border Tax Disputes

The introduction of arbitration clauses in EU tax treaties has had a profound impact on the resolution of cross-border tax disputes. By providing a formalized mechanism for dispute resolution, these clauses help prevent lengthy litigation processes and foster a more amicable settlement of disputes. This is particularly important in the context of international business, where uncertainty and prolonged disputes can hinder operations and deter investment. Arbitration offers a more predictable and efficient resolution process, which is crucial for maintaining the confidence of multinational corporations in the EU tax system.

Moreover, arbitration clauses have implications for the balance of power between tax authorities and taxpayers. They offer taxpayers an additional avenue to contest decisions that they perceive as unfair or inconsistent with treaty obligations. This can lead to a more balanced and equitable tax environment, where taxpayers feel they have a fair chance to voice their concerns and seek redress. However, this also places additional pressure on tax authorities to ensure their decisions are well-founded and defensible, as arbitration can expose weaknesses in their positions.

The implementation of arbitration clauses also signals a shift towards greater cooperation and coordination among EU member states. By committing to binding arbitration, states demonstrate a willingness to work collaboratively to resolve disputes, which can enhance mutual trust and understanding. This cooperative approach is essential for addressing the complexities of international taxation and ensuring that tax treaties remain effective tools for managing cross-border economic activities. As the global economy continues to evolve, the role of arbitration in tax treaties is likely to become even more significant, necessitating ongoing assessment and refinement of these clauses to meet the needs of modern businesses.

In conclusion, arbitration clauses in EU tax treaties play a crucial role in the resolution of cross-border tax disputes, offering a structured and efficient alternative to litigation. While they provide numerous benefits, including reducing uncertainty and fostering cooperation between states, they also present challenges that need to be addressed to ensure their effectiveness. As international business continues to grow and evolve, the importance of these clauses will only increase, necessitating ongoing dialogue and adaptation to meet the needs of a dynamic global economy. By understanding and refining the role of arbitration clauses, the EU can continue to promote a fair and predictable tax environment, encouraging investment and economic growth across its member states.