In recent years, the European Union has embarked on a journey to reform its tax treaties, aiming to enhance transparency, combat tax avoidance, and ensure fair taxation across member states. These changes have been driven by the need to adapt to a rapidly evolving global economic landscape and the growing importance of digital economies. This article explores the scope of these reforms and analyzes their potential economic implications, shedding light on how they may reshape the fiscal policies within the EU.

Evaluating the Scope of EU Tax Treaty Reforms

The scope of EU tax treaty reforms is extensive, reflecting the bloc’s commitment to creating a more integrated and fair tax system. One of the primary focuses has been to address the loopholes that multinational corporations exploit to shift profits and minimize tax liabilities. By amending existing treaties and introducing new regulations, the EU aims to curb base erosion and profit shifting (BEPS) activities, thereby ensuring that companies pay taxes where economic activities are carried out and value is created.

Moreover, these reforms are characterized by the introduction of measures to enhance transparency and information exchange between member states. The implementation of the Common Reporting Standard (CRS) and the automatic exchange of financial account information are pivotal in this regard. Such initiatives are designed to improve the detection of tax evasion and increase the accountability of both corporations and individuals, fostering a culture of compliance across the EU.

Another significant aspect of the reforms is the harmonization of tax rules to minimize discrepancies between national tax systems. This involves aligning definitions, tax bases, and anti-abuse provisions to reduce the opportunities for aggressive tax planning. By creating a more uniform tax environment, the EU seeks to eliminate unfair tax competition and promote a level playing field for businesses operating within the single market.

Analyzing Changes and Their Economic Implications

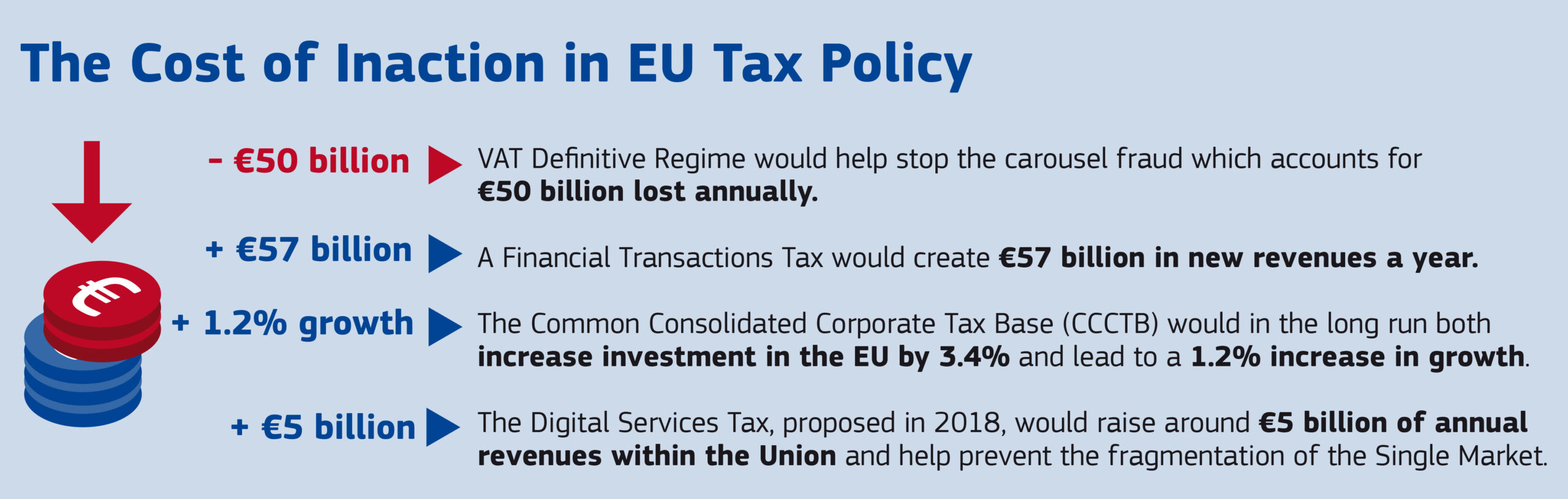

The economic implications of the recent EU tax treaty reforms are profound, with potential ripple effects across various sectors. One anticipated outcome is the stabilization of tax revenues for member states, as the crackdown on tax avoidance is expected to increase the tax base. This could lead to more resources for public spending and investment, ultimately supporting economic growth and development within the region.

However, these reforms may also pose challenges for multinational corporations that have long relied on complex tax structures to optimize their tax liabilities. The increased compliance costs and the need to adapt to new regulations could impact their operational strategies and profitability. Consequently, some businesses might reconsider their investment decisions within the EU, potentially affecting job creation and economic dynamism in certain member states.

On a broader scale, the reforms could enhance the EU’s competitiveness in the global market by fostering a more transparent and predictable tax landscape. By setting high standards for tax governance, the EU positions itself as a leader in the fight against tax evasion and aggressive tax planning. This not only improves the bloc’s image but also attracts businesses that value ethical practices and long-term sustainability, thus contributing to a more resilient and equitable global economy.

In conclusion, the recent reforms to EU tax treaties represent a significant step towards achieving a fairer and more transparent tax system within the bloc. While these changes bring about challenges and necessitate adjustments for businesses, they also offer opportunities for economic growth and improved governance. As the EU continues to refine its tax policies, it remains crucial to balance the interests of member states, corporations, and citizens to ensure a sustainable and prosperous economic future. The success of these reforms will ultimately depend on their effective implementation and the cooperation of all stakeholders involved.