Income tax systems across the European Union (EU) are a complex mosaic of policies and regulations, reflecting the diverse economic landscapes and political philosophies of its member states. Understanding these systems is crucial for both residents and businesses operating within the EU. This article delves into the intricacies of income tax systems across the EU, highlighting key differences and similarities among member states.

An Analytical Overview of EU Income Tax Systems

The European Union, while fostering economic integration, allows each member state to design its own income tax system. This autonomy results in a wide spectrum of tax structures, ranging from flat tax rates to highly progressive tax scales. The primary goal of these systems is to generate revenue for public services and infrastructure while ensuring equitable wealth distribution. However, the methods and efficiency of achieving these goals vary significantly.

Income taxation in the EU typically includes both personal and corporate income taxes. Personal income tax rates can range from as low as 10% in some countries to over 50% in others, depending on the individual’s income level and the country’s fiscal policies. Corporate tax rates are also diverse, with some nations offering competitive rates to attract foreign investment, while others maintain higher rates to fund social welfare programs.

In addition to rate differences, member states employ various tax credits, deductions, and allowances to shape their income tax systems. These tools can significantly impact the effective tax rate experienced by individuals and businesses. For instance, countries with high nominal tax rates may offer substantial deductions for families, education, or healthcare, effectively lowering the tax burden. This complexity necessitates a deep understanding of local tax laws for accurate financial planning and compliance.

Key Differences and Similarities Across Member States

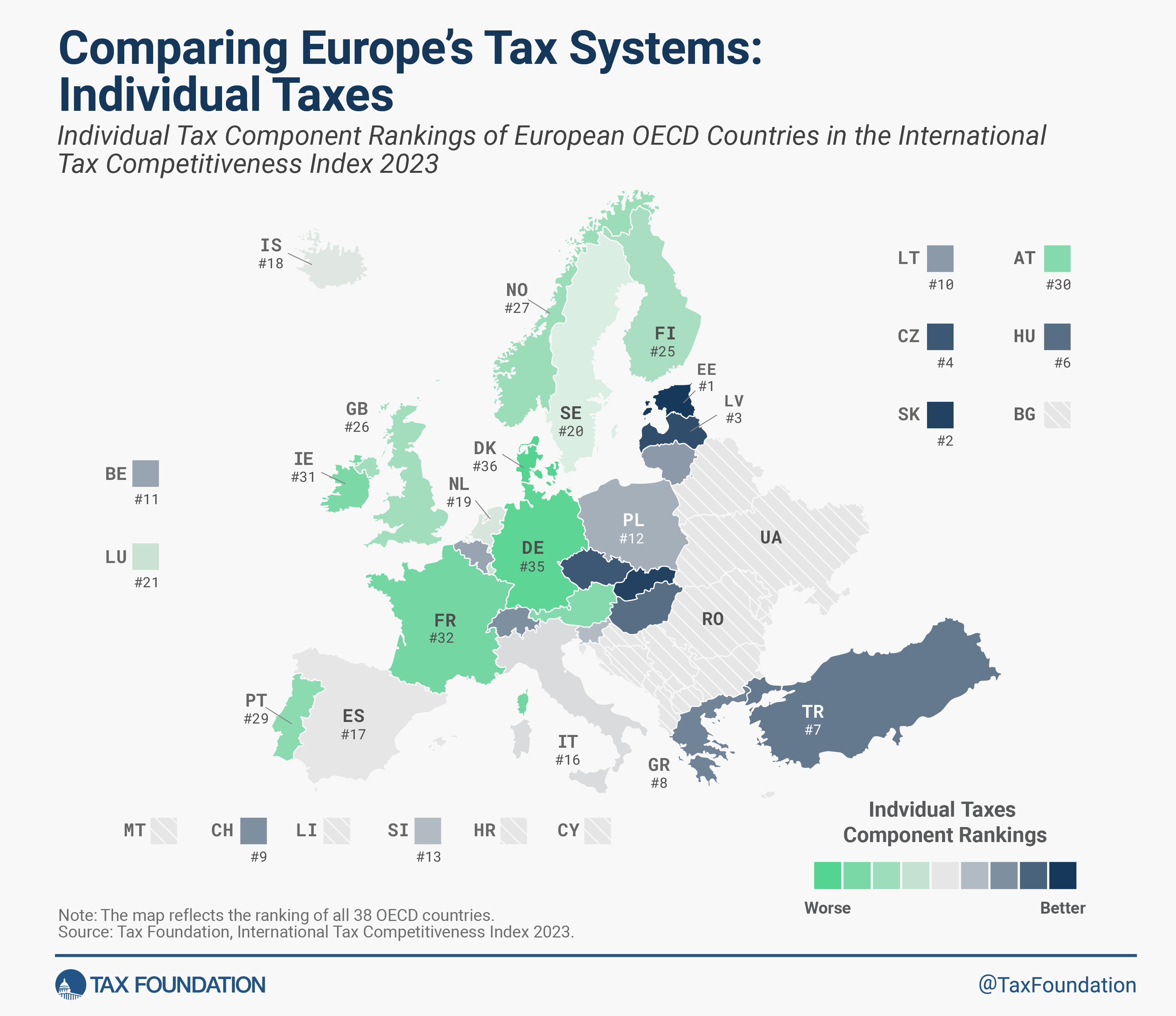

One of the most notable differences among EU member states’ income tax systems is the approach to tax progressivity. Countries such as Sweden and Denmark employ highly progressive tax systems, where higher income brackets are taxed at significantly higher rates. This approach aims to reduce income inequality and fund comprehensive social programs. In contrast, countries like Bulgaria and Hungary utilize flat tax systems, applying a single tax rate to all income levels, which simplifies tax administration but may have different implications for income distribution.

Another key difference lies in the treatment of corporate income taxes. Ireland, for example, is renowned for its low corporate tax rate of 12.5%, which has attracted numerous multinational corporations to establish their European headquarters there. On the other hand, countries like France and Germany maintain higher corporate tax rates but offer various incentives and deductions for research and development, aiming to foster innovation and long-term economic growth.

Despite these differences, there are similarities that bind the EU’s income tax systems. All member states adhere to certain EU directives and regulations that aim to prevent tax evasion and ensure fair competition. For instance, the Anti-Tax Avoidance Directive (ATAD) sets common rules to combat tax avoidance practices, while the Common Consolidated Corporate Tax Base (CCCTB) proposal seeks to harmonize the calculation of taxable income for corporations operating in multiple EU countries. These measures help create a more level playing field and promote financial transparency across the union.

Navigating the diverse landscape of income tax systems in the EU requires a nuanced understanding of each member state’s unique approach to taxation. While differences in tax rates, progressivity, and corporate tax policies reflect the varied economic and social priorities of each country, there are also unifying elements aimed at fostering transparency and fairness. For individuals and businesses operating within the EU, staying informed about these tax systems is essential for effective financial planning and compliance. As the EU continues to evolve, so too will its tax policies, making ongoing analysis and adaptation crucial for all stakeholders.