Tax refunds are more than just a welcome financial boost; they can be a critical part of effective financial planning. For physical persons residing in the UK, Ireland, and Luxembourg, understanding how to maximize their tax refunds can lead to significant monetary benefits. This article delves into the top tax refund benefits for individuals in these regions, offering practical advice and real-world examples to help taxpayers make the most of their returns.

Maximizing Your Tax Refund: UK, Ireland, Luxembourg

Navigating the tax refund process in the UK can be straightforward if you know where to look for deductions and credits. For example, UK taxpayers can claim tax relief on job-related expenses, such as uniforms, tools, and professional subscriptions. Additionally, if you have made charitable donations via Gift Aid, you can claim back the tax paid on those donations. Another often overlooked area is the Marriage Allowance, which allows one partner in a lower tax bracket to transfer a portion of their personal allowance to their higher-earning spouse, potentially increasing the refund.

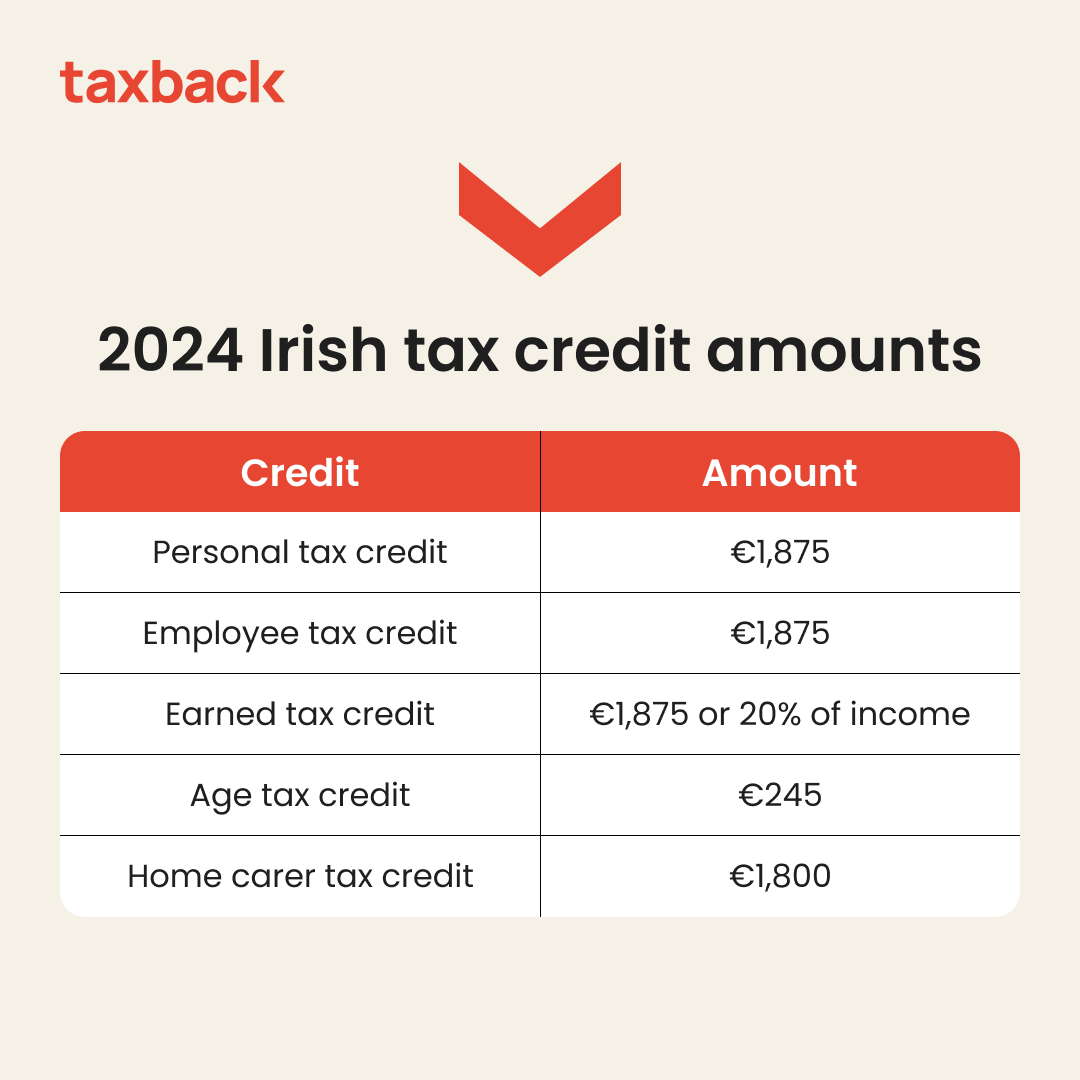

In Ireland, maximizing your tax refund involves understanding and capitalizing on various credits and reliefs available. For instance, the Home Carer Tax Credit is available to married couples or civil partners where one spouse works in the home caring for children or other dependents. Medical expenses not covered by insurance can also be claimed, providing a significant refund opportunity. Additionally, tax credits are available for tuition fees, making education costs more manageable and potentially increasing your refund.

Luxembourg offers several avenues for maximizing tax refunds, largely due to its progressive tax system and generous deductions. Taxpayers can benefit from deductions for childcare expenses, mortgage interest, and even commuting costs. For example, if you use public transportation for commuting, you can claim a deduction for the cost of your travel pass. Additionally, Luxembourg provides tax relief for contributions to pension schemes and life insurance policies, which can significantly boost your refund.

Key Benefits for Physical Persons in These Regions

One of the key benefits for physical persons in the UK is the ability to claim back overpaid taxes. This can occur for various reasons, such as changes in employment status, incorrect tax codes, or pension contributions. For instance, if you have been on emergency tax during a job transition, you can reclaim the overpaid amount once your tax code is corrected. This ensures that you are not out of pocket due to administrative errors.

In Ireland, a significant benefit is the availability of the Earned Income Tax Credit for self-employed individuals. This credit can substantially reduce the amount of tax owed, leading to a higher refund. Additionally, Ireland’s tax system allows for the carry-forward of unclaimed credits and reliefs for up to four years. This means that if you missed out on claiming certain deductions in previous years, you still have the opportunity to file for them and potentially receive a sizable refund.

Luxembourg residents benefit from the country’s family-friendly tax policies, which include generous allowances and deductions for dependents. For example, families can claim a deduction for each child, which reduces the overall taxable income and increases the potential refund. Moreover, Luxembourg’s tax system allows for the splitting of income between spouses, which can result in a lower overall tax rate and a higher refund. This is particularly advantageous for families with a single breadwinner or significant income disparity between partners.

Understanding and leveraging the various tax refund benefits available in the UK, Ireland, and Luxembourg can lead to substantial financial gains for physical persons. By staying informed about the specific deductions, credits, and reliefs offered in each region, taxpayers can ensure they are not leaving money on the table. Whether it’s through job-related expenses, medical costs, or family allowances, taking the time to maximize your tax refund can make a significant difference in your financial well-being.