The European Union (EU) is undergoing a significant transformation towards a digital economy, a shift that promises to enhance competitiveness and innovation across member states. One of the critical components facilitating this transformation is the network of tax treaties that govern cross-border economic activities. These treaties play a pivotal role in shaping the fiscal landscape for digital enterprises, ensuring that taxation does not become a barrier to growth and innovation. This article delves into the intricate relationship between tax treaties and the EU’s digital economy transformation, examining how they contribute to economic growth and innovation.

Exploring Tax Treaties in the EU’s Digital Shift

Tax treaties are bilateral agreements between countries that aim to avoid double taxation and prevent tax evasion. In the context of the EU, these treaties form a vital part of the regulatory framework that supports digital businesses operating across borders. By providing clear guidelines on the taxation of digital services and products, these treaties help reduce the risk of double taxation, thereby encouraging companies to expand their operations within the EU. They establish which country has taxing rights over specific types of income, which is crucial for digital businesses that often operate in multiple jurisdictions simultaneously.

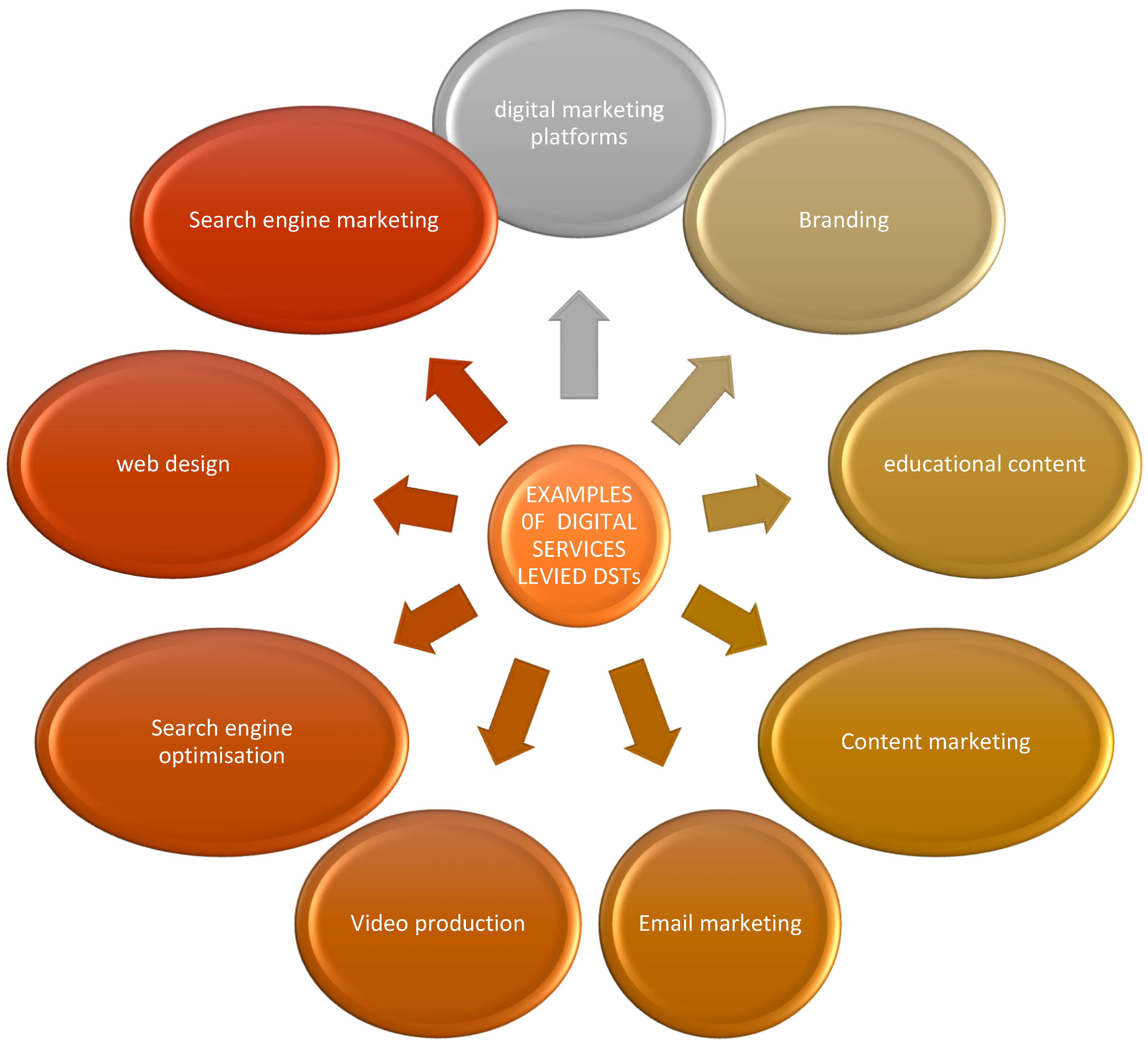

Moreover, the EU’s tax treaties are increasingly being adapted to address the unique challenges posed by the digital economy. Traditional tax rules were designed for tangible goods and services, but the digital economy requires new approaches to issues like the allocation of taxing rights and the definition of a permanent establishment. Recent updates to tax treaties often include provisions that cater to the digital economy, such as clauses on digital services taxes and the treatment of revenue generated from intangibles. These adaptations help create a more predictable tax environment for digital companies, fostering an ecosystem where innovation can thrive.

The digital shift in the EU is also supported by initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project, which aims to ensure that digital companies pay taxes where they generate value. EU member states incorporate BEPS recommendations into their tax treaties to address the challenges of the digital economy. By aligning their tax systems with international standards, EU countries can provide a level playing field for digital enterprises, enhancing the attractiveness of the EU as a hub for digital innovation and investment.

Impact on Economic Growth and Innovation

Tax treaties play a crucial role in promoting economic growth by facilitating cross-border trade and investment. For the EU’s digital economy, these agreements help remove fiscal barriers that could otherwise hinder the expansion of digital services. By mitigating the risks of double taxation and tax disputes, treaties create a more stable and predictable business environment. This stability is essential for attracting foreign investment, as companies are more likely to invest in regions where tax obligations are clear and manageable.

Innovation is another significant beneficiary of the tax treaty network within the EU. By providing a framework that supports cross-border research and development (R&D) collaborations, tax treaties enable digital companies to leverage resources and talent from across the EU. This collaborative environment fosters the development of new technologies and digital solutions, contributing to the EU’s goal of becoming a global leader in digital innovation. Furthermore, tax treaties often include provisions that encourage R&D activities by offering tax incentives or credits, further stimulating innovation within the digital sector.

However, the impact of tax treaties on economic growth and innovation is not without challenges. As digital businesses evolve, there is a continuous need for tax treaties to adapt to new business models and technologies. Ensuring that these agreements remain relevant and effective requires ongoing dialogue between EU member states and international bodies. By staying ahead of the curve, the EU can ensure that its tax treaties continue to support the digital economy’s growth and innovation, ultimately contributing to the region’s long-term economic prosperity.

As the EU continues its journey towards a fully digital economy, the role of tax treaties will remain central to this transformation. These agreements provide the necessary framework to facilitate cross-border digital activities, promoting economic growth and fostering innovation. By adapting to the unique challenges of the digital age, tax treaties help create a conducive environment for businesses to thrive. However, the dynamic nature of the digital economy requires constant vigilance and adaptation. The EU must continue to refine its tax treaty network to ensure that it remains a leader in global digital innovation, driving forward its economic agenda in an increasingly interconnected world.