Lobbying has long been a potent force in shaping legislative landscapes, and the realm of tax policy within the European Union (EU) is no exception. Among the myriad of actors exerting influence, two stand out for their significant lobbying power: Deloitte and PwC. These Big Four accounting firms not only offer consultancy services but also play a pivotal role in molding tax legislation through their extensive lobbying efforts. This article delves into the mechanisms and impacts of their influence on EU tax policies.

Deloitte and PwC’s Lobbying Power in EU Tax Policies

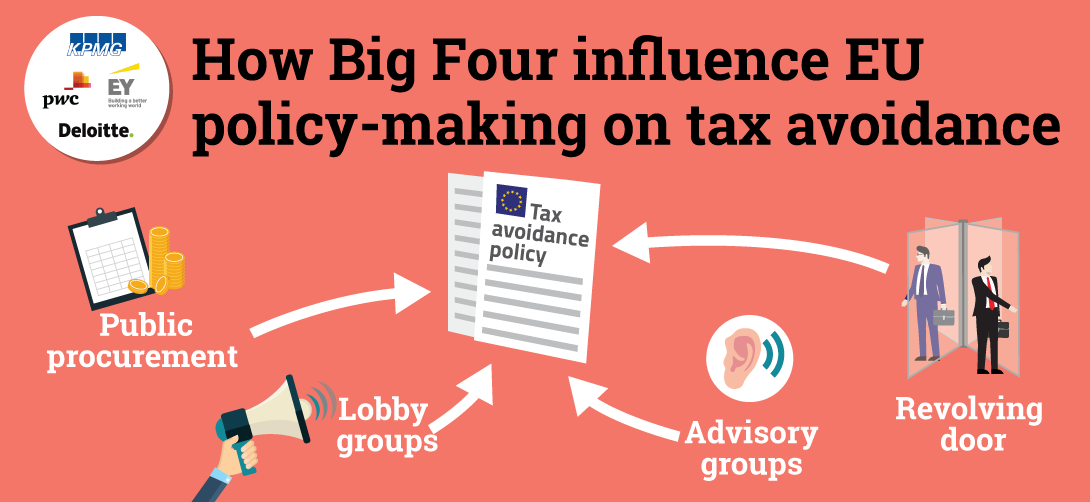

Deloitte and PwC, as two of the largest professional services firms globally, wield considerable influence in the corridors of EU power. Their lobbying activities are extensive and multifaceted, encompassing direct interactions with policymakers, participation in advisory committees, and submission of position papers. Deloitte and PwC have established robust networks within the European Commission, the European Parliament, and other key EU institutions. These connections enable them to stay ahead of regulatory changes and effectively advocate for policies that align with their interests and those of their clients.

Both firms employ dedicated lobbying teams, staffed with former policymakers and experts in EU legislative processes. These professionals bring invaluable insider knowledge and strategic acumen to their lobbying efforts. Through these teams, Deloitte and PwC can craft compelling arguments, backed by rigorous data and analysis, to influence tax policy debates. They often position themselves as indispensable advisors, providing technical expertise that policymakers may lack, thereby shaping the legislative agenda in subtle yet profound ways.

Moreover, Deloitte and PwC invest heavily in building relationships with key stakeholders, including national tax authorities, business associations, and other influential entities. By fostering these connections, they create a broad coalition of support for their policy positions. This networked approach amplifies their lobbying power, allowing them to exert significant pressure on EU institutions. The firms’ ability to mobilize a wide array of allies underscores the sophistication and reach of their lobbying strategies.

Analyzing the Impact on European Tax Legislation

The lobbying efforts of Deloitte and PwC have had a tangible impact on European tax legislation. One notable area is the formulation of tax avoidance and evasion policies. Both firms have been active in shaping the EU’s approach to tackling these issues, often advocating for measures that balance stringent oversight with business-friendly provisions. Their influence is evident in the nuanced and sometimes lenient aspects of EU tax directives, which reflect the compromises forged through intense lobbying.

Another significant impact is seen in the realm of digital taxation. As the EU grapples with how to tax digital giants effectively, Deloitte and PwC have positioned themselves as key interlocutors. They have provided extensive input on proposals such as the Digital Services Tax (DST) and the OECD’s Base Erosion and Profit Shifting (BEPS) project. Their contributions often emphasize the need for international cooperation and the avoidance of unilateral measures, advocating for frameworks that mitigate compliance burdens for multinational corporations.

Furthermore, Deloitte and PwC’s lobbying efforts have influenced the development of transfer pricing rules within the EU. These rules, which govern how intra-company transactions are priced, are crucial for multinational enterprises managing cross-border operations. By actively participating in consultations and offering technical guidance, the firms have helped shape transfer pricing regulations that are both complex and flexible, allowing for interpretative leeway that can benefit their clients. This influence underscores the firms’ ability to steer legislation in ways that foster a favorable operating environment for multinational businesses.

The role of Deloitte and PwC in shaping EU tax legislation highlights the profound impact that corporate lobbying can have on public policy. Through sophisticated strategies, extensive networks, and deep expertise, these firms have managed to leave an indelible mark on the legislative landscape. While their influence can lead to well-informed and balanced policies, it also raises questions about the transparency and equity of the legislative process. As the EU continues to evolve its tax framework, the interplay between lobbying power and public interest will remain a critical area of scrutiny and debate.