In the rapidly evolving landscape of global business, the mobility of startups and entrepreneurs is increasingly influenced by international tax policies. Within the European Union (EU), tax treaties play a crucial role in determining how and where businesses choose to establish themselves. These treaties, designed to prevent double taxation and encourage cross-border trade, have a significant impact on the decision-making processes of innovative startups and ambitious entrepreneurs. This article delves into how EU tax treaties affect this sector, examining both the opportunities and challenges they present.

Analyzing EU Tax Treaties: A Startup Perspective

Tax treaties within the EU are primarily aimed at eliminating the risk of double taxation for businesses operating across borders. For startups, this means a more predictable and stable financial environment, which is essential for growth and sustainability. By reducing the tax burden on cross-border activities, these treaties make it financially viable for startups to operate in multiple countries within the EU. This can lead to increased market access, diversified revenue streams, and enhanced competitive advantage.

However, the complexity of these treaties can be daunting for startups, which often lack the resources and expertise to navigate intricate tax regulations. Each EU member state has its own set of tax rules and treaties, creating a patchwork of regulations that can be challenging to manage. For startups, this may mean additional costs related to legal and financial advisory services, potentially diverting funds from core business activities such as research and development or market expansion.

Moreover, the varying implementation of tax treaties across the EU can lead to inconsistencies that affect startups differently depending on their location. While some countries may offer favorable conditions for entrepreneurs, others might impose stricter regulations, affecting the overall attractiveness of certain regions. This disparity can influence startups’ decisions on where to establish their headquarters or expand their operations, ultimately shaping the entrepreneurial landscape within the EU.

How Tax Policies Shape Entrepreneurial Mobility

Tax policies are a critical factor in determining the mobility of entrepreneurs within the EU. Favorable tax conditions can act as a magnet for talent, drawing entrepreneurs to regions where they can maximize their financial outcomes. Countries with attractive tax incentives for startups, such as lower corporate tax rates or tax credits for research and development, often see a higher influx of entrepreneurial activity. These policies can significantly enhance a country’s reputation as a startup hub, attracting both local and international entrepreneurs.

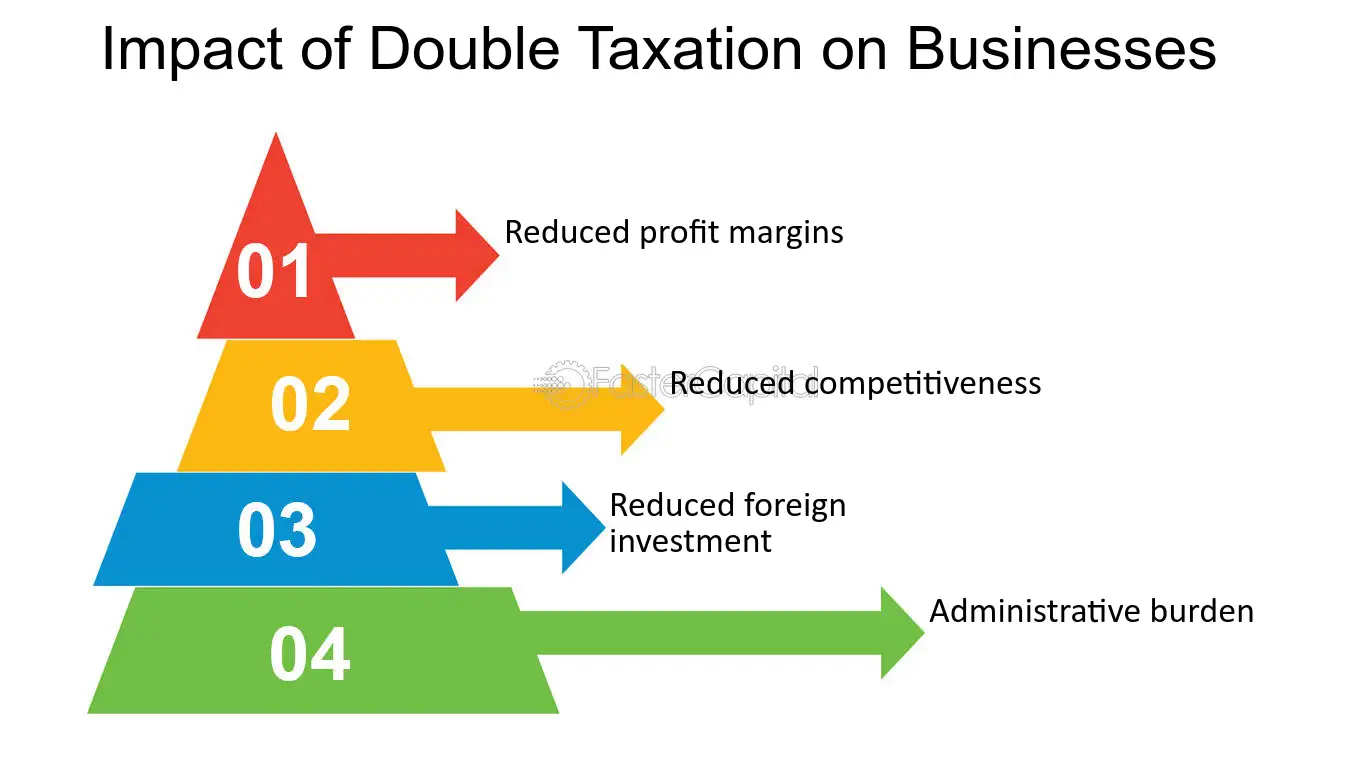

Conversely, stringent tax regimes can hinder mobility, discouraging entrepreneurs from setting up or expanding their businesses in certain regions. High tax rates, complex compliance requirements, and the risk of double taxation can act as deterrents, pushing entrepreneurs to seek more favorable environments elsewhere. This can lead to an uneven distribution of entrepreneurial activity across the EU, with some regions flourishing while others lag behind due to less competitive tax policies.

The mobility of entrepreneurs is also influenced by the consistency and predictability of tax policies. Startups thrive in environments where they can plan long-term strategies without the fear of sudden regulatory changes. Therefore, transparent and stable tax policies are crucial in fostering a conducive environment for entrepreneurial mobility. EU tax treaties, by providing a framework for tax cooperation and dispute resolution, play an essential role in maintaining this stability, thereby encouraging startups and entrepreneurs to explore cross-border opportunities.

In conclusion, EU tax treaties significantly shape the mobility and growth of startups and entrepreneurs within the region. While they provide a framework that can facilitate cross-border operations and reduce tax burdens, the complexity and variability of these treaties pose challenges that startups must navigate. As the EU continues to harmonize its tax policies, striking a balance between creating a competitive tax environment and ensuring compliance will be key. Ultimately, the effectiveness of these treaties in fostering entrepreneurial mobility will depend on their ability to offer both stability and flexibility, allowing startups to thrive in an increasingly interconnected global economy.