For students working part-time in Sweden, Finland, and Norway, understanding the intricacies of tax refunds can be a financial game-changer. Balancing academic responsibilities with part-time employment is challenging enough without the added complexity of tax regulations. This article aims to demystify the tax refund processes in these Nordic countries, providing practical insights and comparative analysis to help student workers maximize their financial returns.

Understanding Tax Refunds for Part-Time Student Workers

Tax refunds are essentially reimbursements from the government to taxpayers who have overpaid their taxes throughout the year. For part-time student workers, this can often be the case due to the lower income brackets they typically fall into. In Sweden, for example, students may be eligible for a tax refund if they earn below a certain threshold. The Swedish Tax Agency (Skatteverket) automatically calculates and issues refunds, but students must ensure their tax returns are correctly filed to benefit.

In Finland, the process is somewhat similar, but with unique nuances. Here, students are entitled to a tax card (verokortti) that dictates how much tax should be withheld from their earnings. If a student earns less than the annual tax-free allowance, they can apply for a refund. Keeping track of earnings and ensuring that the tax card is updated with accurate income predictions can help avoid overpayment and ensure timely refunds.

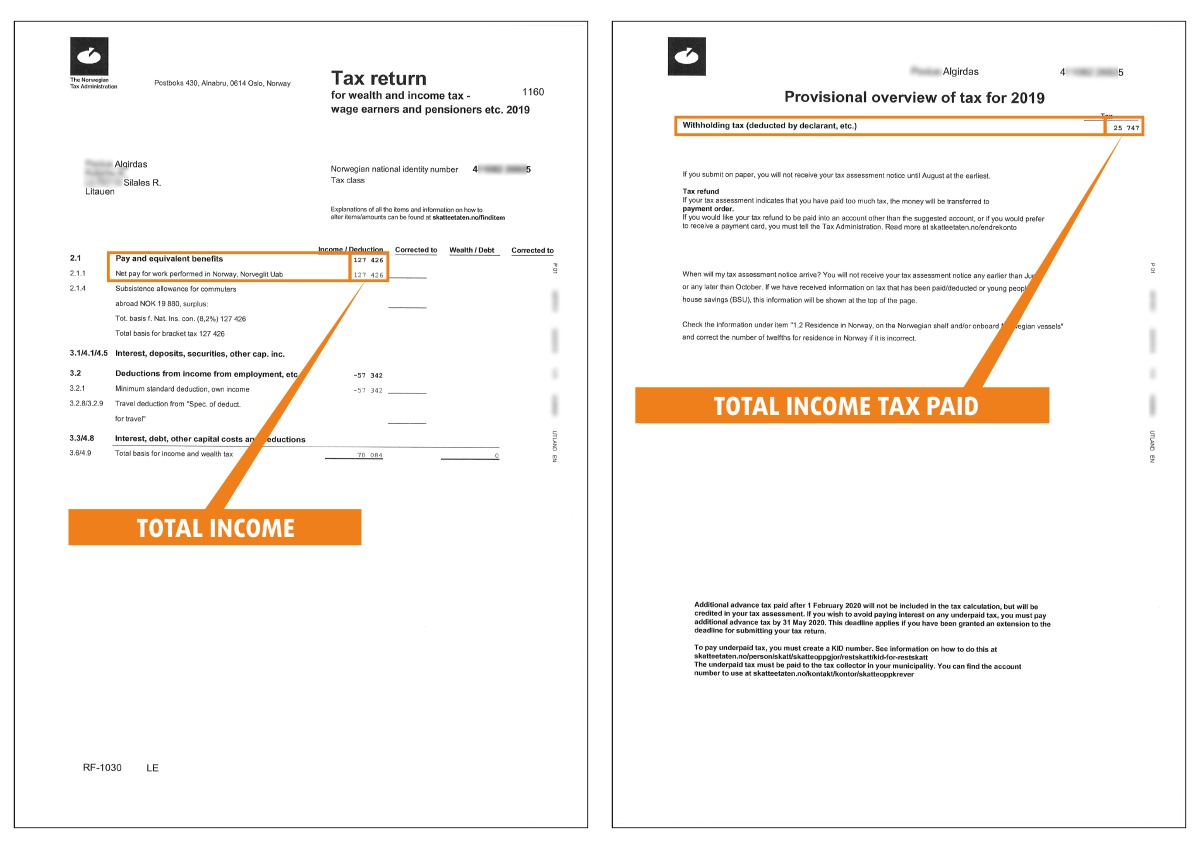

Norway operates on a slightly different model with its tax deduction card (skattekort). Students must apply for this card, which determines the tax rate based on anticipated annual income. If a student’s income is lower than expected, they can apply for a refund at the end of the tax year. Understanding how to navigate the Norwegian tax system, including the importance of submitting accurate income forecasts, is crucial for maximizing refunds.

Comparing Tax Refund Policies in Sweden, Finland, and Norway

When comparing tax refund policies across these three countries, several key differences and similarities emerge. In Sweden, the tax refund process is largely automated, which can be advantageous for students who may not have the time or expertise to manage their taxes closely. However, accurate and timely submission of tax returns is essential to benefit from this system.

Finland’s approach, with its verokortti, places more responsibility on the student to manage their tax affairs. While this can be more cumbersome, it also offers greater flexibility. Students can adjust their tax card throughout the year if their income changes, potentially reducing the amount of tax withheld and increasing their take-home pay. This proactive management can lead to larger refunds if the student’s actual income is lower than anticipated.

Norway’s skattekort system requires students to apply for a tax deduction card, similar to Finland’s verokortti. However, the Norwegian system places a significant emphasis on accurate income forecasting. Students who misestimate their income may find themselves either overpaying or underpaying taxes, leading to adjustments at the end of the year. The Norwegian tax authority (Skatteetaten) provides tools and resources to help students estimate their income more accurately, but the onus remains on the student to ensure compliance.

Navigating the tax refund landscape as a part-time student worker in Sweden, Finland, and Norway can be complex, but understanding the specific processes and requirements in each country can lead to significant financial benefits. By staying informed and proactive, students can ensure they are not overpaying taxes and can maximize their refunds. Whether it’s leveraging automated systems in Sweden, managing tax cards in Finland, or accurately forecasting income in Norway, each country’s approach offers unique opportunities and challenges. With the right knowledge and tools, students can make the most of their part-time earnings and secure the refunds they deserve.