In an increasingly globalized world, businesses and individuals are constantly seeking ways to optimize their tax liabilities. Slovakia, with its favorable tax regime and strategic location in Central Europe, has emerged as an attractive destination for tax optimization. This article delves into the strategies for optimizing taxes in Slovakia, with a particular focus on cross-border tax planning and the use of holding companies.

Optimizing Taxes in Slovakia: A Strategic Overview

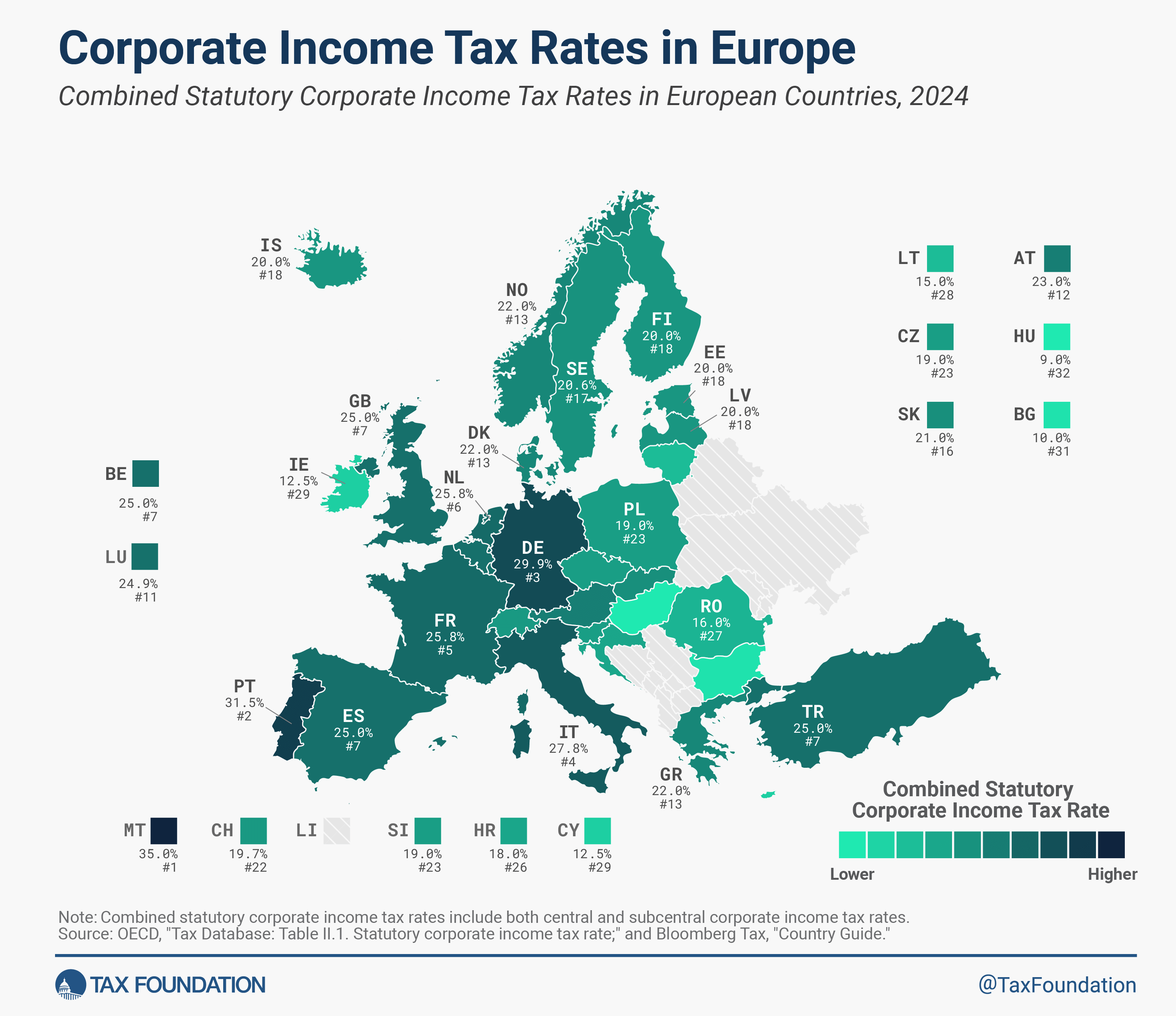

Slovakia offers a competitive corporate tax rate of 21%, which is lower than many other European countries. This makes it an appealing option for businesses looking to minimize their tax burden. Additionally, Slovakia has a broad network of double taxation treaties with over 60 countries, which helps prevent the same income from being taxed in multiple jurisdictions. These treaties often provide reduced withholding tax rates on dividends, interest, and royalties, further enhancing the attractiveness of Slovakia as a tax optimization hub.

Another key aspect of Slovakia’s tax regime is its participation exemption, which allows dividends received from both domestic and foreign subsidiaries to be exempt from corporate income tax. This exemption is particularly beneficial for holding companies, as it enables them to repatriate profits from their subsidiaries without incurring additional tax liabilities. Furthermore, capital gains from the sale of shares in subsidiaries can also be exempt from tax, provided certain conditions are met.

Slovakia also offers various incentives to attract foreign investment, such as tax holidays, grants, and subsidies for research and development activities. These incentives can significantly reduce the overall tax burden for businesses operating in Slovakia. By taking advantage of these incentives, companies can not only optimize their tax liabilities but also reinvest the savings into their operations, fostering growth and innovation.

Cross-Border Planning and Holding Companies Explained

Cross-border tax planning involves structuring business operations and transactions in a way that minimizes tax liabilities across different jurisdictions. In the context of Slovakia, this often involves establishing a holding company that can take advantage of the country’s favorable tax regime. A holding company is a parent corporation that owns enough voting stock in another company to control its policies and management. By setting up a holding company in Slovakia, businesses can benefit from the participation exemption and the extensive network of double taxation treaties.

One of the primary benefits of using a holding company in Slovakia is the ability to centralize the management of international subsidiaries. This can lead to significant administrative efficiencies and cost savings. Moreover, the holding company can serve as a conduit for repatriating profits from foreign subsidiaries to the parent company, taking advantage of reduced withholding tax rates under Slovakia’s double taxation treaties. This can result in substantial tax savings for multinational enterprises.

In addition to tax benefits, establishing a holding company in Slovakia can also provide legal and financial advantages. For instance, Slovakia’s legal framework offers robust protection for shareholders and intellectual property, which can be crucial for businesses operating in multiple jurisdictions. Furthermore, the country’s stable political and economic environment makes it a reliable base for international operations. By leveraging these advantages, businesses can not only optimize their tax liabilities but also enhance their overall operational efficiency and competitiveness.

In conclusion, Slovakia presents a compelling case for businesses and individuals seeking to optimize their tax liabilities through strategic cross-border planning and the use of holding companies. With its favorable tax regime, extensive network of double taxation treaties, and various investment incentives, Slovakia offers a conducive environment for tax optimization. By understanding and leveraging the benefits of Slovakia’s tax system, businesses can achieve significant tax savings, enhance their operational efficiency, and foster long-term growth.