Starting a business as a sole trader in Slovakia can be an attractive option for many aspiring entrepreneurs due to its straightforward process and relatively low barriers to entry. However, navigating the legal landscape and understanding the key steps involved are crucial for ensuring a smooth and compliant start. This article delves into the essential legal considerations and step-by-step guidelines for establishing your sole proprietorship in Slovakia.

Navigating the Legal Landscape for Sole Traders in Slovakia

Understanding the legal framework is the first critical step for any sole trader in Slovakia. The country operates under a civil law system, and the rules governing business operations are clearly defined in the Commercial Code. As a sole trader, you will be operating under the designation "živnostník," which is a form of self-employment. It is essential to familiarize yourself with the specific legal requirements, including registration procedures, tax obligations, and compliance with local regulations.

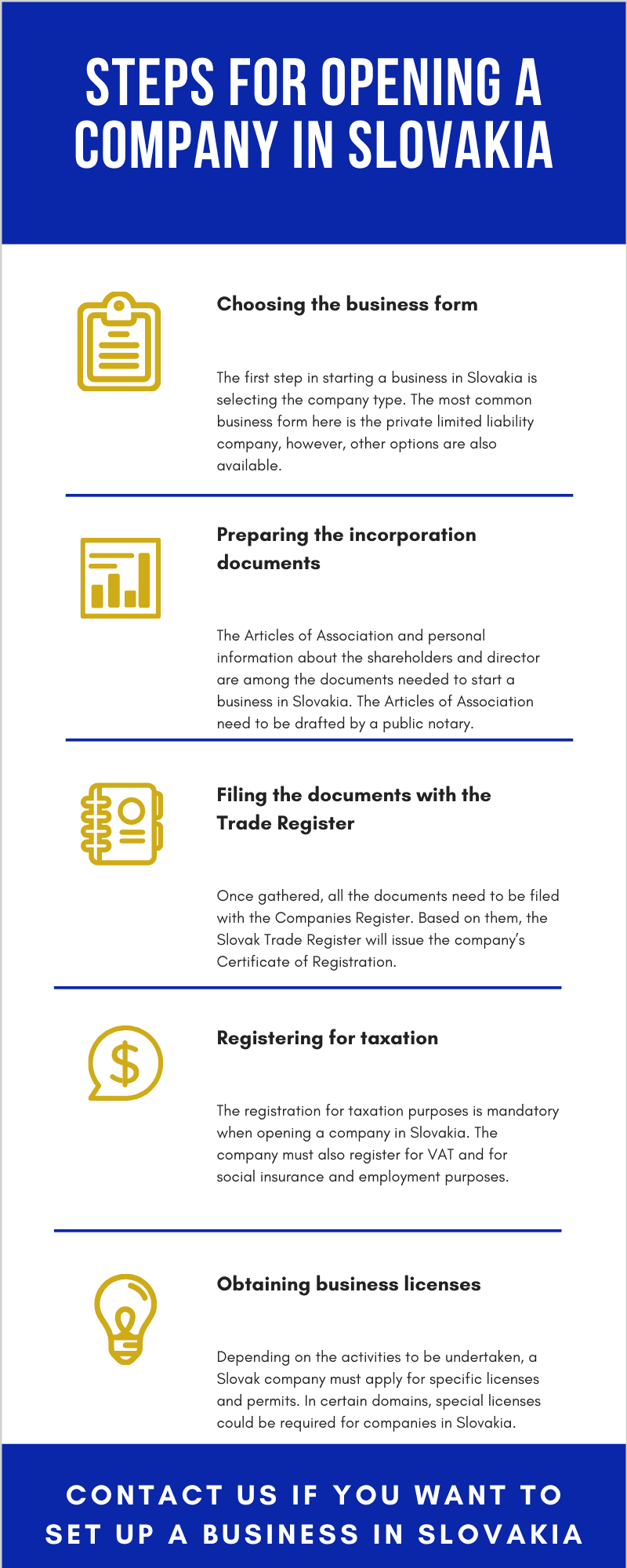

One of the primary legal requirements for starting as a sole trader in Slovakia is obtaining a trade license. This requires submitting an application to the Trade Licensing Office, along with necessary documentation such as proof of identity, residence, and professional qualifications if applicable. The process is designed to be efficient, typically taking a few days to a couple of weeks. However, it is advisable to ensure all paperwork is meticulously prepared to avoid any delays.

Taxation is another critical aspect of the legal landscape. Sole traders in Slovakia are subject to personal income tax, and it is mandatory to register with the Tax Office within 30 days of commencing business activities. Additionally, depending on the nature of your business, you may need to register for VAT if your annual turnover exceeds a certain threshold. Understanding these tax obligations and maintaining accurate financial records are vital for staying compliant and avoiding potential penalties.

Key Steps to Establishing Your Sole Proprietorship

The first step in establishing your sole proprietorship in Slovakia is conducting thorough market research. This involves identifying your target market, analyzing competitors, and understanding the demand for your products or services. A well-researched business plan can serve as a roadmap, helping you make informed decisions and setting a solid foundation for your venture.

Once you have a clear business plan, the next step is to register your trade. As mentioned earlier, this involves applying for a trade license from the Trade Licensing Office. Alongside the application, you will need to submit various documents, including a clean criminal record certificate, proof of residence, and professional qualifications if required. It is also important to choose an appropriate business name and ensure it is not already in use by another entity.

After obtaining your trade license, you must register with the relevant authorities. This includes registering with the Tax Office, Social Insurance Agency, and Health Insurance Company. Each of these registrations is crucial for ensuring your business operates legally and meets all statutory obligations. For instance, registering with the Social Insurance Agency is essential for accessing social benefits and pensions, while health insurance registration ensures you are covered for medical expenses.

Starting a business as a sole trader in Slovakia can be a rewarding endeavor if approached with careful planning and a thorough understanding of the legal requirements. By navigating the legal landscape effectively and following the key steps to establish your sole proprietorship, you can set the stage for a successful and compliant business operation. Whether you are a local entrepreneur or an expatriate looking to tap into the Slovak market, this guide provides a solid foundation to help you achieve your entrepreneurial goals.