The structure of income tax systems within the European Union (EU) has long been a topic of intense debate and varied implementation. Central to this discourse are the competing models of progressive and flat income tax rates. While progressive tax rates scale with an individual’s income, flat tax rates impose a single percentage on all taxpayers, regardless of their earnings. The choice between these two models affects not only government revenues but also economic equality and social welfare. This article examines the comparative aspects of progressive and flat tax systems within the EU, exploring their economic impacts and the policy debates they engender across member states.

Comparative Analysis: Progressive vs. Flat Tax Rates in the EU

Progressive income tax systems, where the tax rate increases as income rises, are prevalent in many EU countries, including Germany, France, and Spain. These systems are designed to ensure that higher earners contribute a larger share of their income to public finances, thereby reducing income inequality and funding social services. The philosophy behind progressive taxation aligns with the principles of redistributive justice, aiming to balance the scales between the wealthy and the less affluent.

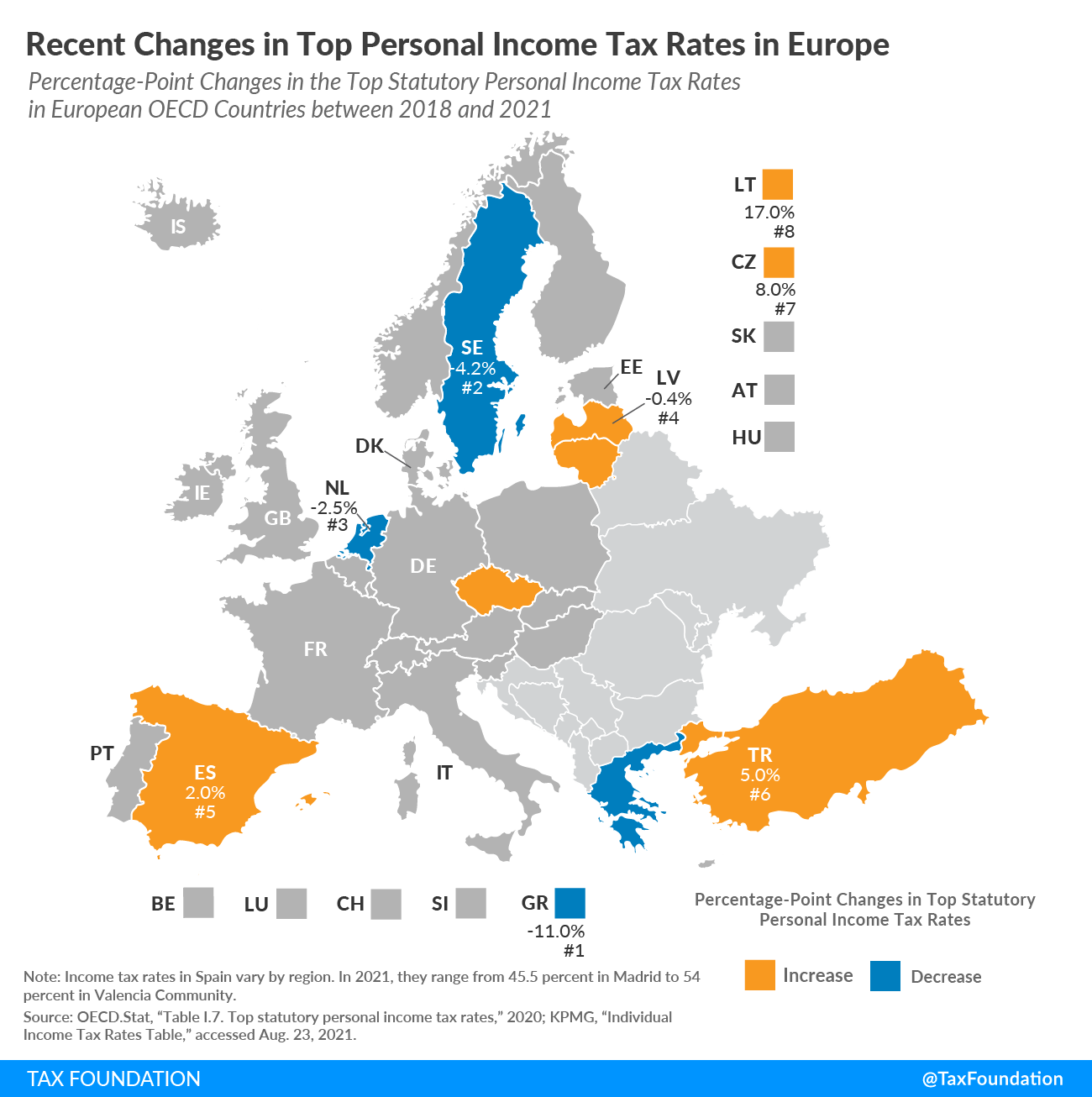

In contrast, several EU countries have adopted flat tax rates, notably Estonia, Latvia, and Lithuania. These nations apply a uniform tax rate to all taxpayers, regardless of income level. Proponents argue that flat taxes simplify the tax system, reduce administrative burdens, and incentivize economic growth by not penalizing higher earnings. The simplicity and predictability of flat tax systems are often cited as key advantages, potentially attracting foreign investment and encouraging entrepreneurship.

However, the dichotomy between progressive and flat tax rates is not absolute. Some countries employ a hybrid approach, incorporating elements of both systems. For instance, the Czech Republic and Slovakia have experimented with flat tax rates but include certain exemptions and deductions that introduce a degree of progressivity. This hybridization reflects an ongoing search for a balanced approach that maximizes economic efficiency while addressing social equity concerns.

Economic Impacts and Policy Debates Across Member States

The economic impacts of progressive and flat tax systems are multifaceted, influencing everything from government revenue to income distribution and economic growth. Progressive tax systems are often lauded for their ability to generate substantial public revenue, which can be reinvested in social programs, education, and healthcare. These investments, in turn, can promote long-term economic stability and social cohesion. However, critics argue that high marginal tax rates may discourage high earners from working harder or investing, potentially stifacing innovation and economic dynamism.

On the other hand, flat tax systems are praised for their potential to boost economic growth by creating a more favorable environment for investment and entrepreneurship. By maintaining lower and more predictable tax rates, flat tax countries may attract businesses and skilled workers, fostering a competitive economic landscape. However, the downside is that flat taxes can exacerbate income inequality, as they do not adjust for an individual’s ability to pay. This can lead to underfunded public services and increased social disparity, posing significant challenges for social welfare systems.

Policy debates around income tax structures are vigorous and ongoing across the EU. Advocates of progressive taxation argue that it is essential for maintaining social justice and providing public goods, while supporters of flat taxes emphasize economic efficiency and simplicity. These discussions are further complicated by external factors such as economic cycles, demographic changes, and global market dynamics. As member states grapple with these issues, the choice between progressive and flat tax systems remains a central question in the broader context of fiscal policy and economic strategy.

The debate over progressive versus flat income tax rates in the EU encapsulates broader questions about economic policy, social justice, and fiscal responsibility. Each system has its merits and drawbacks, influencing not only the distribution of wealth but also the overall economic health of member states. As the EU continues to navigate the complexities of a diverse and interconnected economy, the balance between equitable taxation and economic efficiency will remain a pivotal issue. The ongoing policy debates and economic analyses will undoubtedly shape the future of tax systems in Europe, reflecting the evolving priorities and values of its societies.