In the intricate web of international trade, Value Added Tax (VAT) rules can often be a labyrinth for businesses to navigate, especially for non-EU traders. Luxembourg, known for its strategic location and favorable business climate, has specific VAT regulations that can impact how non-EU entities conduct their operations. Understanding these rules is crucial for compliance and optimizing tax strategies.

Luxembourg’s VAT Rules: A Primer for Non-EU Traders

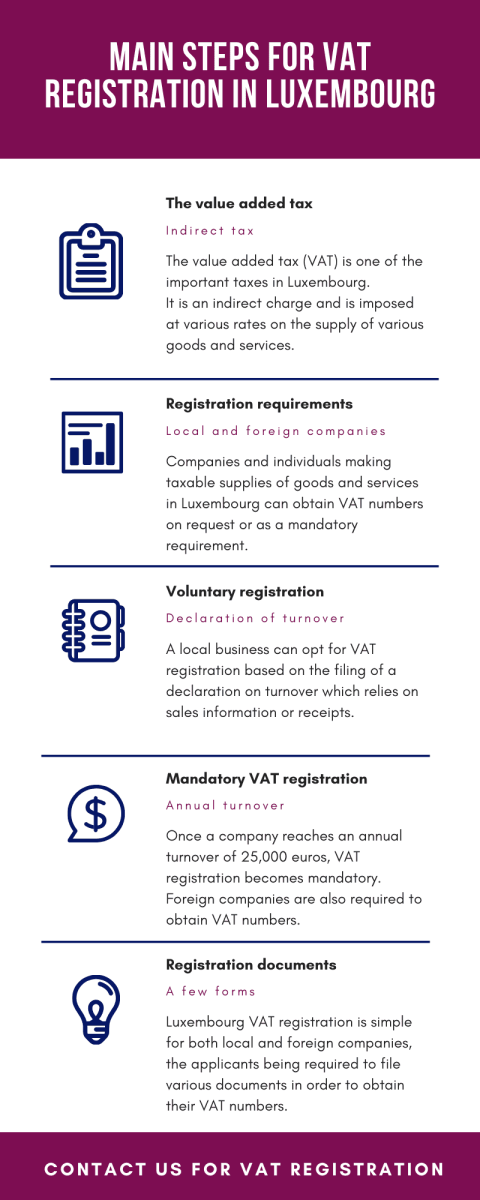

Luxembourg’s VAT system, like that of other EU countries, is governed by the EU VAT Directive, but it also incorporates national specifics. For non-EU traders, the most critical aspect to understand is the VAT registration requirement. If a non-EU business supplies goods or services in Luxembourg, it may need to register for VAT in the country, depending on the nature and volume of transactions. For instance, a U.S. company selling software to Luxembourg customers must assess whether its activities necessitate VAT registration.

Another essential component is the VAT rate applicable to different goods and services. Luxembourg has one of the lowest standard VAT rates in the EU at 17%, with reduced rates of 14%, 8%, and 3% for specific categories such as food, books, and medical supplies. Non-EU traders must be aware of these rates to accurately calculate the VAT on their invoices and ensure proper pricing strategies. For example, a Canadian firm exporting medical devices to Luxembourg would benefit from the reduced 3% VAT rate, impacting its cost structure and competitive positioning.

Moreover, non-EU traders must consider the place of supply rules, which determine where VAT should be accounted for. These rules can be complex, particularly for digital services and cross-border transactions. For instance, if an Australian company provides online consulting services to a Luxembourg client, the place of supply rules will dictate whether the Australian firm must charge Luxembourg VAT or if the reverse charge mechanism applies, shifting the VAT liability to the Luxembourg customer.

Navigating Compliance: Key Challenges and Solutions

One of the primary challenges non-EU traders face is the VAT registration process itself. The administrative burden can be significant, requiring detailed documentation and a thorough understanding of local regulations. Non-EU businesses must submit various forms, including proof of business activities and financial statements, which can be daunting without local expertise. Engaging a local tax advisor or VAT specialist can streamline this process, ensuring accurate and timely registration.

Another challenge is the ongoing VAT compliance, which involves regular filings and payments. Non-EU traders must submit periodic VAT returns, detailing their taxable transactions and VAT collected. This process requires meticulous record-keeping and an understanding of Luxembourg’s reporting standards. Failure to comply can result in penalties and interest charges. Utilizing VAT compliance software or outsourcing to a VAT service provider can mitigate these risks by automating calculations and ensuring adherence to deadlines.

Finally, non-EU traders must stay abreast of changes in VAT legislation. Luxembourg, like other EU countries, periodically updates its VAT rules to align with EU directives and address economic shifts. For example, recent changes in e-commerce VAT rules require non-EU sellers to collect VAT on low-value goods sold to EU consumers. Staying informed about such changes is crucial for maintaining compliance and optimizing tax strategies. Subscribing to regulatory updates and participating in industry forums can help non-EU traders stay ahead of the curve.

Navigating Luxembourg’s VAT rules can be a complex endeavor for non-EU traders, but with the right knowledge and resources, it is manageable. Understanding the registration requirements, applicable VAT rates, and place of supply rules is the first step toward compliance. Addressing the challenges through strategic planning and leveraging local expertise can further streamline the process. As global trade continues to evolve, staying informed and adaptable will be key to successful operations in Luxembourg’s dynamic market.