Navigating tariff classifications in the European Union (EU) can be a daunting task for businesses engaged in international trade. Misclassification of goods can lead to costly delays, fines, and even legal repercussions. Understanding the intricacies of the EU’s tariff classification system is crucial for compliance and optimizing trade operations. This article provides a detailed overview of how to navigate EU tariff classifications effectively, along with key strategies for accurate tariff code identification.

Understanding EU Tariff Classifications: A Primer

Tariff classifications in the European Union are governed by the Combined Nomenclature (CN), a system that aligns with the Harmonized System (HS) developed by the World Customs Organization (WCO). The CN provides a standardized method for describing and coding goods, which facilitates international trade and statistical analysis. The CN is updated annually to reflect changes in technology, trade patterns, and international trade agreements, making it essential for businesses to stay up-to-date with the latest version.

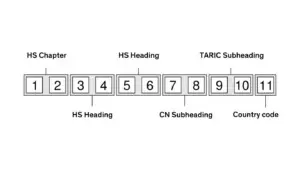

The CN is structured into 21 sections and 99 chapters, each covering a specific category of goods. Chapters are further divided into headings and subheadings, which provide more detailed descriptions of products. Each product is assigned an eight-digit CN code, with the first six digits corresponding to the HS code and the last two digits representing EU-specific classifications. This hierarchical structure ensures a uniform approach to tariff classification across all member states.

To navigate the CN effectively, businesses must understand the General Rules for the Interpretation of the Combined Nomenclature (GRIs). These rules provide guidelines on how to classify goods based on their characteristics, composition, and intended use. The GRIs are applied in a sequential manner, meaning that if a product cannot be classified under one rule, the next rule is considered. Mastering the GRIs is essential for accurate tariff classification and avoiding disputes with customs authorities.

Key Strategies for Accurate Tariff Code Identification

Accurate tariff code identification begins with a thorough understanding of the product being classified. This involves analyzing the product’s physical characteristics, composition, and intended use. Detailed product descriptions, technical specifications, and samples can aid in this process. Businesses should also consider consulting with manufacturers or suppliers to obtain precise information about the product’s origin and components.

Another key strategy is to leverage the EU’s online tools and resources for tariff classification. The European Commission’s TARIC (Integrated Tariff of the European Communities) database is an invaluable resource that provides detailed information on tariff codes, duty rates, and applicable regulations. The TARIC database is updated regularly and can be accessed free of charge. Additionally, the EU’s Binding Tariff Information (BTI) system allows businesses to obtain legally binding classification decisions from customs authorities, providing certainty and reducing the risk of disputes.

Finally, businesses should consider seeking professional assistance for complex tariff classification issues. Customs brokers, trade consultants, and legal experts specializing in international trade can provide valuable insights and guidance. These professionals possess in-depth knowledge of tariff classification rules and can help businesses navigate the complexities of the CN. Engaging with industry associations and participating in training programs can also enhance a business’s tariff classification capabilities.

Successfully navigating tariff classifications in the European Union requires a combination of knowledge, resources, and strategic planning. By understanding the structure and rules of the Combined Nomenclature, leveraging available tools and resources, and seeking professional assistance when needed, businesses can ensure accurate tariff code identification. This not only facilitates smooth customs clearance but also optimizes trade operations and enhances compliance. As global trade continues to evolve, staying informed and proactive in tariff classification practices will be essential for businesses to thrive in the international marketplace.