In the intricate web of international trade, determining the origin of goods is crucial for businesses seeking to benefit from preferential tariff treatments. The European Union (EU) offers such advantages to countries with which it has trade agreements, fostering economic growth and facilitating smoother trade flows. However, navigating the rules and regulations to ascertain the origin of goods can be complex. This article delves into the nuances of preferential tariff treatments in the EU and outlines the steps to identify the origin of goods for tariff purposes.

Understanding Preferential Tariff Treatments in the EU

Preferential tariff treatments are mechanisms through which the EU reduces or eliminates tariffs on goods imported from specific countries. These treatments stem from various trade agreements, such as Free Trade Agreements (FTAs) and Generalized System of Preferences (GSP), designed to enhance trade by making it more cost-effective. The primary goal of these agreements is to support economic development, reduce trade barriers, and promote international cooperation.

The EU’s preferential tariff schemes benefit a wide array of countries, particularly developing nations, by making their exports more competitive in the European market. For businesses, this translates into significant cost savings and improved market access. However, to qualify for these benefits, goods must meet stringent rules of origin criteria, proving that they genuinely originate from the beneficiary country.

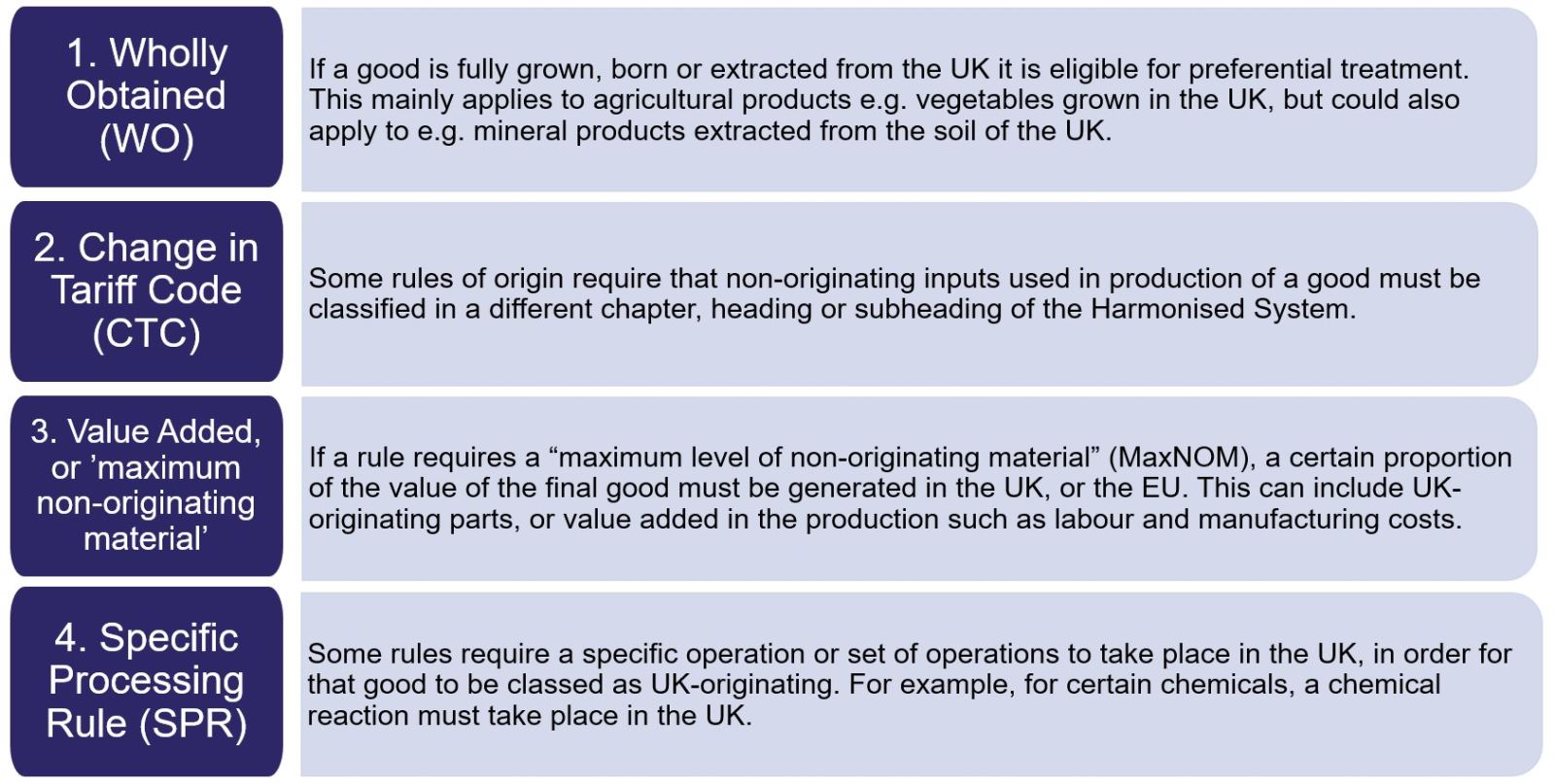

Understanding the rules of origin is critical for businesses to leverage preferential tariff treatments effectively. These rules determine the economic nationality of a product and are often based on criteria such as wholly obtained goods, substantial transformation, or a combination of both. Compliance with these rules ensures that only eligible products receive preferential treatment, thereby preventing trade deflection and unfair competition.

Steps to Identify the Origin of Goods for Tariffs

The first step in identifying the origin of goods for preferential tariff treatments is to determine the specific trade agreement applicable to the goods in question. Each agreement has its own set of rules of origin, which can vary significantly. Businesses must consult the relevant agreement’s provisions to understand the specific criteria their products must meet. This often involves analyzing the tariff classification of the goods and the nature of the production processes involved.

Once the applicable agreement is identified, businesses need to gather and document evidence proving the origin of the goods. This documentation can include certificates of origin, supplier declarations, and manufacturing records. Ensuring thorough and accurate documentation is essential, as customs authorities will scrutinize these documents to verify compliance with the rules of origin. Inaccurate or incomplete documentation can lead to delays, penalties, or denial of preferential tariff treatment.

Finally, businesses should stay updated on any changes to trade agreements and rules of origin. The international trade landscape is dynamic, with agreements being renegotiated and rules being revised. Regularly reviewing official EU publications, consulting with trade experts, and participating in industry forums can help businesses stay informed and compliant. By proactively managing their compliance processes, businesses can maximize their benefits under preferential tariff treatments and maintain a competitive edge in the market.

Determining the origin of goods for preferential tariff treatments in the EU is a meticulous process that requires a deep understanding of trade agreements and rules of origin. By following the outlined steps—identifying the relevant agreement, gathering necessary documentation, and staying informed about regulatory changes—businesses can effectively navigate the complexities of international trade. In doing so, they can unlock significant cost savings and enhance their market competitiveness, ultimately contributing to a more robust and dynamic global trading system.