The European Union (EU) has long been a formidable player on the global economic stage, leveraging a range of strategies to attract foreign investment. Among these strategies, tax treaties play a pivotal role. These agreements are not merely fiscal tools; they are strategic instruments that help shape the EU’s investment landscape. By negotiating tax treaties with countries around the world, the EU aims to create an attractive environment for foreign investors, balancing competitive tax rates with regulatory stability. This article delves into how the EU strategically uses tax treaties to draw in foreign capital and examines the impact of these treaties on the influx of foreign investors.

EU’s Strategic Use of Tax Treaties for Investment

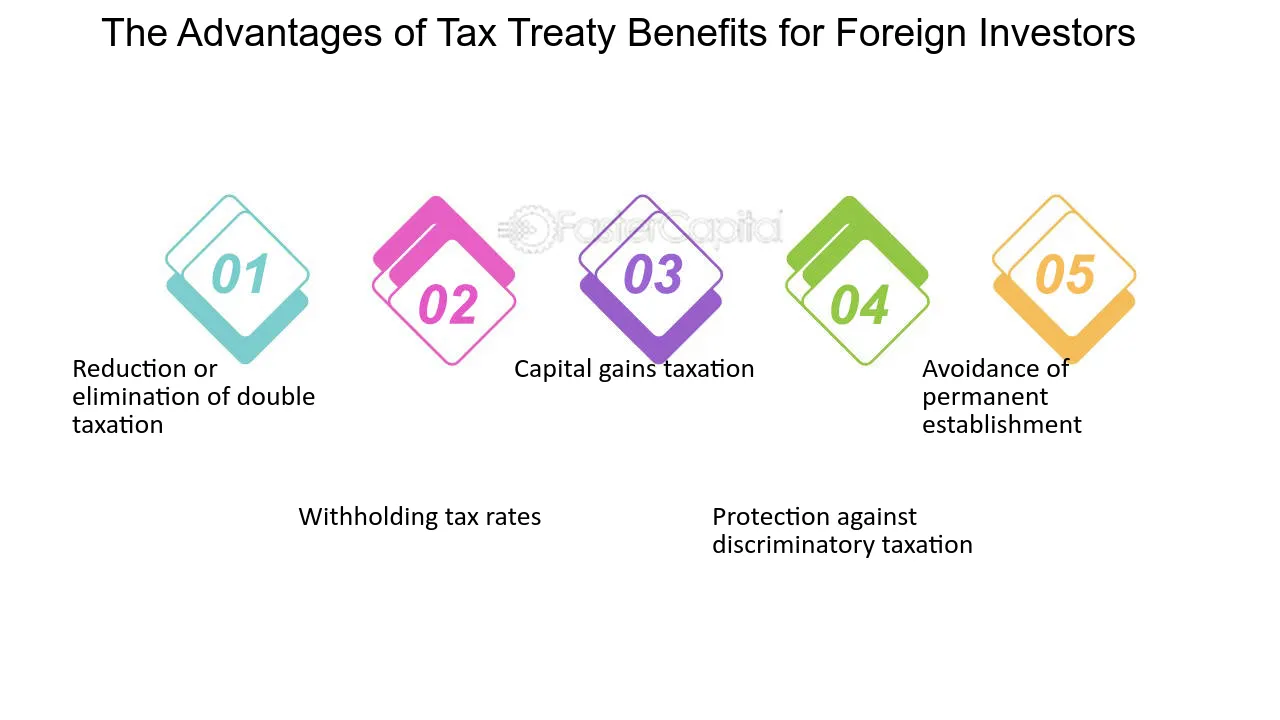

The EU’s strategic deployment of tax treaties is a cornerstone of its economic policy, designed to foster an environment conducive to foreign investment. By establishing bilateral agreements with non-EU countries, the EU aims to eliminate double taxation, thereby reducing the overall tax burden on foreign investors. This reduction not only increases the net returns on investments but also enhances the EU’s competitiveness as an investment destination. These treaties typically include provisions on the taxation of dividends, interest, and royalties, which are crucial for multinational corporations seeking to optimize their tax obligations.

Moreover, tax treaties serve as a mechanism for the EU to project stability and predictability in its tax regime. In a global economy where regulatory unpredictability can deter investment, the assurance provided by these treaties is invaluable. By committing to certain tax rates and rules, the EU mitigates the risk of sudden regulatory changes that could adversely affect investors. This stability is particularly appealing to businesses that require long-term planning and capital allocation, thus bolstering the EU’s attractiveness as an investment hub.

Beyond reducing tax liabilities and ensuring stability, EU tax treaties often include provisions aimed at preventing tax evasion and avoidance. These clauses are crucial for maintaining the integrity of the EU’s tax system while still appealing to foreign investors. By ensuring that investors comply with international tax standards, the EU can attract responsible investment that contributes to sustainable economic growth. This balance between attracting investment and safeguarding tax revenues underscores the strategic sophistication of the EU’s approach to tax treaties.

Analyzing the Impact on Foreign Investor Influx

The impact of the EU’s tax treaties on foreign investor influx is significant and multifaceted. By alleviating the tax burden through these treaties, the EU has successfully attracted a diverse range of investors from around the world. This influx is evident in the steady increase in foreign direct investment (FDI) inflows into the EU over the past decades. Countries like Ireland, the Netherlands, and Luxembourg, known for their extensive network of tax treaties, have particularly benefited, becoming hubs for multinational corporations seeking favorable tax conditions.

However, the influence of tax treaties extends beyond mere numbers. These agreements have also shaped the nature of investments entering the EU. Investors are not only drawn by the prospect of reduced taxes but also by the strategic advantages offered by EU member states in terms of access to the single market and a skilled workforce. This has led to a diversification of investment portfolios, with sectors such as technology, pharmaceuticals, and finance seeing significant growth due to the influx of foreign capital.

Despite these positive outcomes, the effectiveness of tax treaties in attracting investment is not without controversy. Critics argue that while tax treaties do attract investment, they may also encourage tax base erosion and profit shifting (BEPS) practices by multinational corporations. This has prompted the EU to continuously refine its tax treaty policies to strike a balance between attracting investment and ensuring tax compliance. The ongoing efforts to align these treaties with international tax standards, such as the OECD’s BEPS project, reflect the EU’s commitment to maintaining a fair and competitive investment environment.

In conclusion, the European Union’s use of tax treaties is a strategic endeavor that plays a crucial role in attracting foreign investment. By offering reduced tax liabilities, regulatory stability, and compliance with international standards, these treaties make the EU an appealing destination for global investors. While the impact of these treaties is largely positive, with increased investment inflows and diversified portfolios, challenges remain in ensuring that these benefits are not undermined by tax avoidance practices. As the EU continues to refine its approach, balancing competitiveness with compliance, tax treaties will remain a vital tool in its economic arsenal, shaping the future of foreign investment in the region.