The European Union (EU) is characterized by its commitment to the free movement of people, goods, services, and capital. However, income tax policies across its member states significantly influence migration patterns within this region. As individuals and businesses seek to maximize their financial well-being, disparities in tax regimes become a critical factor in cross-border movement. This article delves into how income tax policies shape migration trends in the EU and analyzes the fiscal factors driving these decisions.

Income Tax Policies Shape Migration Trends in the EU

Income tax policies are a pivotal factor in migration decisions within the EU. Individuals and families often seek to relocate to countries with more favorable tax regimes to optimize their financial positions. For instance, countries like Ireland and Luxembourg, known for their relatively low personal income tax rates, attract a substantial number of high-income earners and professionals seeking to retain a larger portion of their earnings. Consequently, these tax-friendly destinations experience an influx of skilled labor, which can have significant implications for their economies.

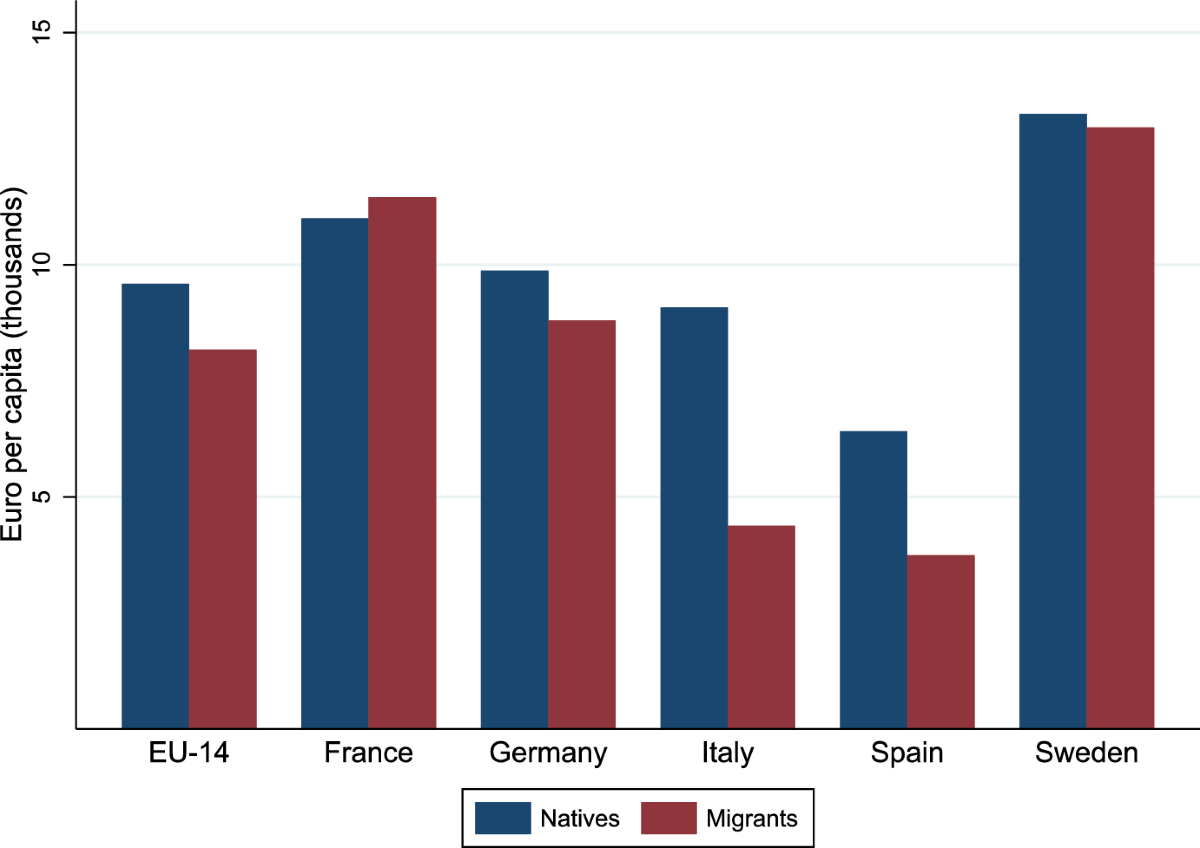

Conversely, countries with higher income tax rates, such as France and Sweden, may witness an outflow of residents, particularly those in higher income brackets. These individuals might migrate to neighboring countries with lower tax burdens, thereby reducing the tax base and potentially impacting public services and social welfare systems in their home countries. This phenomenon, often referred to as "tax flight," highlights the competitive nature of tax policies within the EU and their role in shaping demographic and economic landscapes.

Moreover, income tax policies do not only influence individual migration but also corporate decisions. Companies often establish headquarters or significant operations in countries with favorable corporate tax rates and regulations. This corporate migration can lead to job creation and economic growth in the host countries while potentially diminishing the economic prospects of the countries they leave. Thus, the interplay between personal and corporate income tax policies is a crucial determinant of migration trends within the EU.

Analyzing Fiscal Factors Behind Cross-Border Movement

The decision to migrate based on income tax policies is multifaceted, involving several fiscal factors. One of the primary considerations is the overall tax burden, which includes not just income tax but also social security contributions, property taxes, and indirect taxes like VAT. Countries with lower overall tax burdens tend to be more attractive to both individuals and businesses. For example, Bulgaria and Romania, with their flat tax systems and low overall tax burdens, have become increasingly popular destinations for expatriates and entrepreneurs.

Another critical factor is the availability of tax incentives and deductions. Some EU countries offer specific tax breaks for expatriates or new residents, such as the "30% ruling" in the Netherlands, which allows eligible foreign employees to receive 30% of their gross salary tax-free for up to five years. Such incentives can significantly enhance the financial appeal of relocating, especially for highly skilled workers and executives. These policies not only attract talent but also foster a competitive environment among EU countries to lure desirable migrants.

Additionally, the stability and predictability of tax policies play a crucial role in migration decisions. Frequent changes in tax legislation or the introduction of retroactive taxes can create an uncertain fiscal environment, deterring potential migrants. Countries that maintain consistent and transparent tax policies are often seen as more reliable and attractive destinations. For instance, Germany’s stable tax regime provides a sense of security for long-term financial planning, making it a favored choice for both individuals and multinational corporations.

Income tax policies are undeniably influential in shaping migration trends within the EU. As individuals and businesses seek to optimize their financial circumstances, the disparities in tax regimes across member states become a significant factor in their relocation decisions. Understanding the fiscal factors behind cross-border movement provides valuable insights into the economic and demographic shifts within the region. Policymakers must consider these dynamics to create balanced tax systems that can attract and retain talent while ensuring sustainable economic growth.