Double Taxation Agreements (DTAs) serve as pivotal instruments in the realm of international trade, especially within the European Union (EU). They are designed to facilitate cross-border economic activities by preventing the same income from being taxed in two different jurisdictions. As the EU continues to expand its global trade footprint, DTAs have become increasingly significant in shaping trade policies and economic relationships. This article delves into the intricacies of DTAs within the EU and examines their impact on global trade dynamics and policies.

Exploring Double Taxation Agreements in the EU

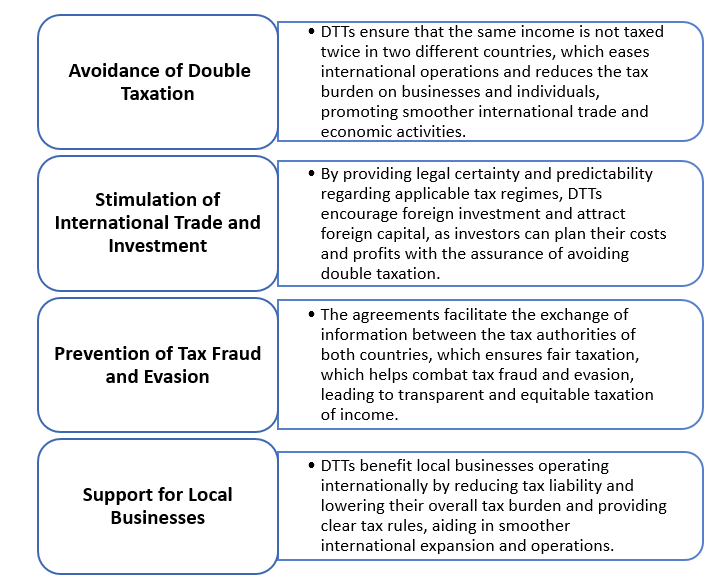

Double Taxation Agreements are treaties between two or more countries aimed at eliminating the double taxation of income or capital. Within the EU, these agreements are crucial for fostering economic cooperation among member states and with non-EU countries. They provide a framework that outlines which country has the right to tax certain types of income, such as dividends, interest, and royalties. The primary objective of DTAs is to remove tax obstacles that could impede cross-border trade and investment, thereby promoting economic integration and growth.

The EU’s approach to DTAs is characterized by a standardized model that aligns with the OECD Model Tax Convention. This model serves as a benchmark for negotiating bilateral treaties, ensuring consistency and fairness in taxation matters across different jurisdictions. By adopting a uniform approach, the EU not only simplifies the negotiation process but also enhances transparency and predictability for businesses operating in multiple countries. This harmonization is vital for reducing administrative burdens and providing legal certainty to taxpayers.

Moreover, DTAs play a significant role in the EU’s broader strategy to combat tax evasion and avoidance. By clearly defining tax liabilities and exchange of information mechanisms, these agreements help authorities track and monitor cross-border financial flows. This not only strengthens the integrity of the tax system but also fosters trust among international trade partners. As such, DTAs are instrumental in creating a conducive environment for sustainable economic development and international cooperation.

Impact on Global Trade Dynamics and Policies

The influence of DTAs extends beyond the borders of the EU, significantly impacting global trade dynamics. By removing the threat of double taxation, these agreements lower the effective tax rates on cross-border transactions, making EU countries more attractive destinations for foreign investment. This, in turn, enhances the competitiveness of EU businesses in the global market, allowing them to expand their operations and tap into new markets without the fear of punitive tax measures.

Furthermore, DTAs contribute to the development of coherent international trade policies by establishing clear tax rules and reducing the potential for disputes between countries. They provide a legal framework that supports the free flow of goods, services, and capital across borders, which is essential for a thriving global economy. By fostering mutual understanding and cooperation, DTAs help mitigate the risks associated with protectionism and unilateral tax measures that could disrupt international trade relations.

In addition, DTAs facilitate the alignment of tax policies with broader economic objectives, such as promoting innovation and sustainable development. By offering tax incentives for specific activities, such as research and development or renewable energy projects, DTAs can drive investment into sectors crucial for future growth. This strategic use of tax policy not only benefits the EU’s economic landscape but also contributes to addressing global challenges, such as climate change and technological advancement.

Double Taxation Agreements are integral to the EU’s trade strategy, serving as a cornerstone for economic collaboration both within the region and globally. By eliminating double taxation, these agreements enhance the EU’s attractiveness as a trade partner and investment destination. They also play a critical role in shaping global trade policies, promoting transparency, and fostering economic resilience. As the world continues to navigate complex economic challenges, the role of DTAs in facilitating seamless international trade and investment will remain indispensable.