The European Union (EU) has long grappled with the challenges posed by tax havens, which often facilitate tax avoidance and undermine the fiscal integrity of member states. Central to this complex landscape are tax treaties, bilateral agreements that aim to prevent double taxation and foster economic cooperation. However, these treaties can also inadvertently enable tax avoidance strategies, complicating the EU’s efforts to combat tax havens. This article explores how tax treaties influence EU policies and the role tax havens play in shaping the EU’s fiscal strategies.

Examining the Influence of Tax Treaties on EU Policies

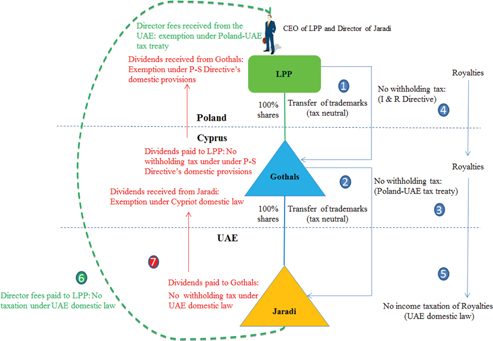

Tax treaties are pivotal instruments in international taxation, designed to eliminate double taxation and promote cross–border trade and investment. Within the EU, these treaties have a significant impact on shaping fiscal policies, as they determine how tax jurisdictions interact with each other. While they are primarily intended to provide clarity and fairness in taxation, their implications often extend beyond these objectives. The treaties can inadvertently create loopholes that multinational corporations exploit to shift profits to low or no-tax jurisdictions, effectively reducing their tax liabilities in higher-tax EU countries.

The EU has recognized these challenges and has been actively working to address them through a coordinated approach. The Base Erosion and Profit Shifting (BEPS) initiative, spearheaded by the Organisation for Economic Co-operation and Development (OECD), has been instrumental in guiding EU policies toward more stringent tax treaty provisions. By implementing anti-abuse clauses and improving transparency, the EU aims to minimize the potential for tax treaties to facilitate tax avoidance. These efforts are part of a broader strategy to enhance tax cooperation and ensure that all countries, including those within the EU, can collect their fair share of taxes.

However, the effectiveness of these measures is often hindered by the diverse interests of EU member states and their individual tax policies. Some countries may prioritize attracting foreign investment through favorable tax regimes, which can conflict with collective EU efforts to curb tax avoidance. This tension underscores the complexity of aligning national tax policies with EU-wide objectives, as member states must balance their economic interests with the need for a fair and transparent tax system. The ongoing debate over tax harmonization within the EU highlights the delicate balance between national sovereignty and the pursuit of a cohesive fiscal policy framework.

The Role of Tax Havens in Shaping EU Fiscal Strategies

Tax havens play a crucial role in shaping the fiscal strategies of the EU, as they present both challenges and opportunities for member states. On one hand, tax havens are often seen as undermining the EU’s tax base, as they enable corporations and wealthy individuals to shift profits and assets offshore, thereby avoiding taxes in their home countries. This has prompted the EU to take a more aggressive stance against tax havens, implementing measures such as the EU blacklist of non-cooperative jurisdictions and increasing pressure on tax havens to comply with international tax standards.

On the other hand, some EU member states have historically adopted tax haven-like policies to attract foreign investment, creating internal competition within the EU. Countries such as Ireland, Luxembourg, and the Netherlands have been criticized for their low corporate tax rates and favorable tax rulings, which can attract multinational corporations at the expense of other EU countries. This intra-EU competition complicates the bloc’s efforts to present a united front against external tax havens and highlights the challenges of achieving fiscal unity among diverse economies.

To address these issues, the EU has been working on initiatives aimed at increasing tax transparency and cooperation both within the bloc and with external partners. Efforts such as the Common Consolidated Corporate Tax Base (CCCTB) and the Anti-Tax Avoidance Directive (ATAD) are designed to harmonize tax rules across the EU and reduce the incentive for profit shifting. Additionally, the EU is actively engaging in international forums to promote global tax reforms that address the challenges posed by tax havens, emphasizing the need for a coordinated global response to ensure fair taxation and sustainable economic growth.

Tax treaties and tax havens are integral to understanding the dynamics of the EU’s fiscal landscape. As the EU continues to refine its policies to address the challenges posed by tax avoidance and profit shifting, the role of tax treaties becomes increasingly complex. Balancing national interests with collective goals is a delicate task that requires careful consideration and cooperation among member states. By fostering transparency and promoting international collaboration, the EU seeks to create a fairer tax system that benefits all its member states, while also addressing the global issue of tax havens.