The European Union (EU) plays a pivotal role in shaping international tax policies, particularly through its network of tax treaties that aim to prevent double taxation and fiscal evasion. As financial derivatives become increasingly significant in global markets, understanding how these treaties influence their taxation is crucial for investors and policymakers alike. This article delves into the complexities of EU tax treaties and their impact on the taxation of financial derivatives, providing insights into both the opportunities and challenges presented by these financial instruments.

Examining EU Tax Treaties’ Impact on Derivatives

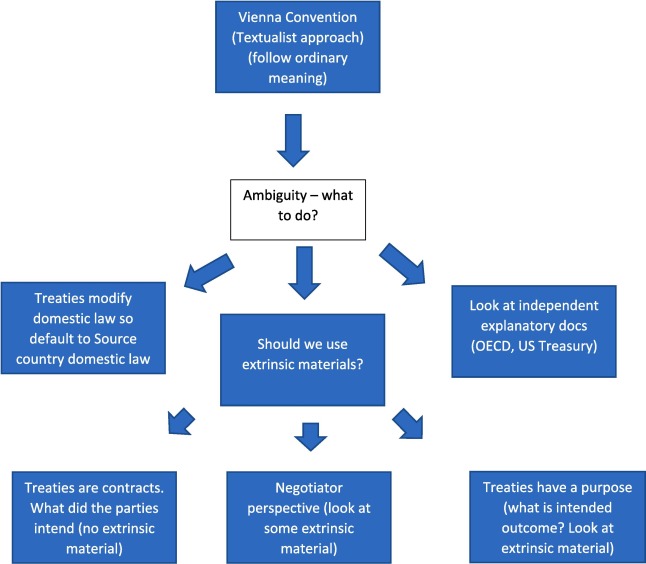

EU tax treaties are designed to facilitate cross-border trade and investment by reducing the risk of double taxation, which occurs when two jurisdictions tax the same income. These treaties typically follow the OECD Model Tax Convention, which provides a framework for allocating taxing rights between countries. For derivatives, which are financial contracts whose value is derived from underlying assets, the application of tax treaties can be intricate. The treatment of income from derivatives, such as interest, dividends, or capital gains, often hinges on the classification of the derivative itself and the nature of the income it generates.

One significant aspect of EU tax treaties is their influence on withholding taxes, which are levied at source on income paid to foreign investors. Derivatives can complicate withholding tax obligations, as they may produce income that is not easily categorized under traditional income types. For instance, income from options or futures may not neatly fit into the definitions provided by tax treaties, leading to potential disputes over the applicable withholding tax rates. Tax treaties aim to mitigate these issues by providing clarity and reducing the likelihood of double taxation on derivative income.

Despite their benefits, EU tax treaties also present challenges in the context of derivatives. The complexity of derivatives markets, combined with the varied approaches of EU member states to taxing these financial instruments, can create uncertainty and administrative burdens for investors. Differences in treaty interpretation and application can lead to inconsistent tax outcomes, potentially affecting the attractiveness of derivatives as investment vehicles. As derivatives continue to evolve, so too must the tax treaties that govern their taxation, necessitating ongoing dialogue and coordination between EU member states.

Navigating Financial Derivatives and EU Tax Policies

The taxation of financial derivatives in the EU is influenced not only by tax treaties but also by domestic tax policies, which can vary significantly between member states. This diversity reflects the unique economic priorities and regulatory environments of each country, leading to a patchwork of tax regimes for derivatives. Investors must navigate this complex landscape to optimize their tax positions, often relying on detailed knowledge of both treaty provisions and domestic tax laws.

EU tax policies on derivatives are evolving in response to the rapid growth and increasing complexity of derivatives markets. Policymakers are tasked with balancing the need for robust tax frameworks that ensure fair taxation with the desire to promote financial innovation and cross-border investment. This balancing act is evident in recent efforts to harmonize tax treatment across the EU, such as initiatives to address base erosion and profit shifting (BEPS) and to enhance transparency in financial markets. These efforts aim to create a more level playing field for derivatives investors while safeguarding national tax revenues.

For investors, the key to successfully navigating EU tax policies on derivatives lies in understanding both the letter and the spirit of tax treaties. This involves not only a thorough grasp of treaty provisions but also an awareness of how these provisions are interpreted and enforced by tax authorities. Professional advice and sophisticated tax planning strategies are often essential for managing the complexities of derivatives taxation, helping investors to minimize tax liabilities and maximize returns. As the EU continues to refine its tax policies, staying informed and adaptable will be crucial for those participating in derivatives markets.

The influence of EU tax treaties on the taxation of financial derivatives is a multifaceted issue that requires careful consideration by investors, policymakers, and tax professionals. While these treaties offer valuable mechanisms for reducing double taxation, their application to the dynamic world of derivatives presents unique challenges. As financial derivatives continue to evolve and play an integral role in global markets, the EU must remain vigilant in updating its tax treaties and policies to reflect these changes. By fostering greater clarity and consistency in the taxation of derivatives, the EU can enhance its competitiveness as a hub for financial innovation and investment.