In the rapidly evolving landscape of global commerce, intellectual property (IP) has become a crucial asset for businesses, especially within the European Union (EU). As companies increasingly rely on IP for competitive advantage and revenue generation, understanding the tax implications associated with IP rights is essential. EU tax treaties play a significant role in shaping how IP is taxed across member states, influencing both corporate strategies and government policies. This article delves into the complexities of EU tax treaties and their impact on the taxation of intellectual property, offering insights into the legal and economic ramifications for businesses operating in the region.

Navigating EU Tax Treaties and Intellectual Property

EU tax treaties are primarily designed to avoid double taxation and prevent fiscal evasion, providing a framework for how various types of income, including royalties from intellectual property, are taxed. These treaties are bilateral agreements between member states (and sometimes with non-member countries) that establish guidelines for taxing cross-border income. For businesses holding IP, these treaties can significantly influence the tax liabilities associated with royalties and other IP-related income streams. By offering reduced withholding tax rates or exemptions, tax treaties can affect where companies choose to locate their intellectual property assets or conduct research and development activities.

The Organization for Economic Co-operation and Development (OECD) Model Tax Convention serves as a foundation for many of these treaties, providing a standardized approach to taxing IP and other income types. However, despite this common framework, variations exist between treaties, leading to a complex and sometimes inconsistent tax environment. For example, while one country may offer favorable treatment for IP royalties, another may impose stricter regulations. This diversity necessitates careful planning and analysis by businesses to optimize their tax positions and avoid unintended liabilities.

Moreover, the EU’s efforts to harmonize tax policies, such as the Anti-Tax Avoidance Directive, further complicate the landscape. These initiatives aim to close loopholes and prevent aggressive tax planning strategies that exploit treaty mismatches. As a result, companies must navigate both the specific provisions of individual treaties and broader EU directives, requiring a sophisticated understanding of international tax law to effectively manage their IP-related tax obligations.

Analyzing Tax Implications for IP in the EU

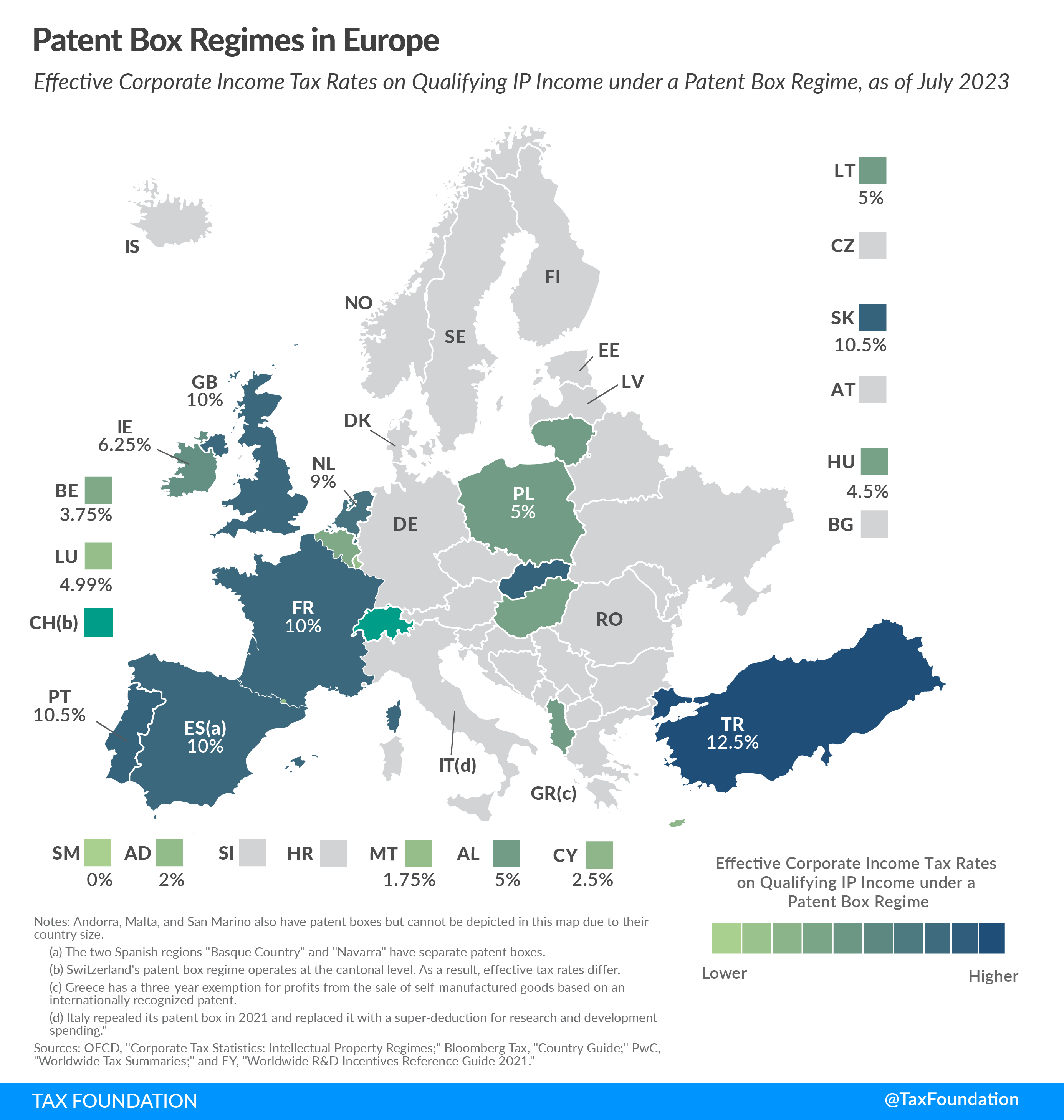

The taxation of intellectual property in the EU is influenced by several factors, including the nature of the IP, its location, and the specific terms of applicable tax treaties. Royalties, which are payments made for the use of IP, are a primary focus of tax treaties, as they often represent a significant revenue stream for IP owners. Treaties typically dictate which country has the right to tax these payments, commonly allocating taxing rights to the country of residence of the IP owner while permitting limited taxation in the source country. This division can lead to strategic decisions about where to domicile IP assets to minimize tax burdens.

However, the potential for tax optimization through treaty shopping—where companies exploit differences between treaties to achieve lower tax rates—has prompted regulatory scrutiny. The EU has introduced measures, such as the Principal Purpose Test (PPT), to prevent treaty abuse and ensure that companies do not inappropriately benefit from favorable tax regimes. This test assesses whether obtaining treaty benefits was one of the main purposes of an arrangement, allowing tax authorities to deny benefits if deemed abusive. Consequently, businesses must ensure that their IP structures are commercially motivated and compliant with both treaty provisions and anti-abuse regulations.

Additionally, the digital economy and the rise of intangible assets present challenges for traditional tax frameworks, which are often ill-equipped to handle the complexities of modern IP transactions. The EU’s ongoing efforts to address these challenges include proposals for digital taxation and reforms to ensure that profits are taxed where value is created. These developments underscore the dynamic nature of IP taxation in the EU and highlight the need for businesses to stay informed about regulatory changes that could impact their tax strategies.

As intellectual property continues to play a pivotal role in the global economy, understanding the implications of EU tax treaties is more important than ever. These treaties not only influence corporate tax strategies but also shape the broader economic environment by affecting decisions on where to invest and innovate. While the EU strives for greater tax harmonization and fairness, companies must navigate a complex web of treaties, directives, and anti-abuse measures to manage their IP-related tax obligations effectively. By staying informed and strategically planning their IP structures, businesses can optimize their tax positions while complying with evolving regulations, ultimately supporting their long-term growth and competitiveness in the European market.