In an era where digital transformation is reshaping the global business landscape, the traditional frameworks of taxation are being rigorously tested. Virtual businesses, which transcend geographical boundaries, pose unique challenges to existing tax structures. The European Union, a major hub of digital commerce, faces the daunting task of adapting its tax treaties to accommodate these changes. This article explores how EU tax treaties are evolving to address the challenges posed by virtual businesses, examining both the navigation of these treaties in the digital age and the specific challenges and solutions that arise for virtual enterprises.

Navigating EU Tax Treaties in the Digital Age

The digital age has brought about a significant shift in how businesses operate, with virtual businesses often lacking a physical presence in the countries where they generate revenue. This evolution challenges the traditional tax treaties, which have historically been based on the concept of physical presence or "permanent establishment" as a criterion for taxation rights. The European Union, recognizing this paradigm shift, is in the process of redefining its tax treaties to better align with the realities of the digital economy. These efforts are focused on ensuring fair taxation while avoiding double taxation, thereby creating a more equitable environment for both digital and traditional businesses.

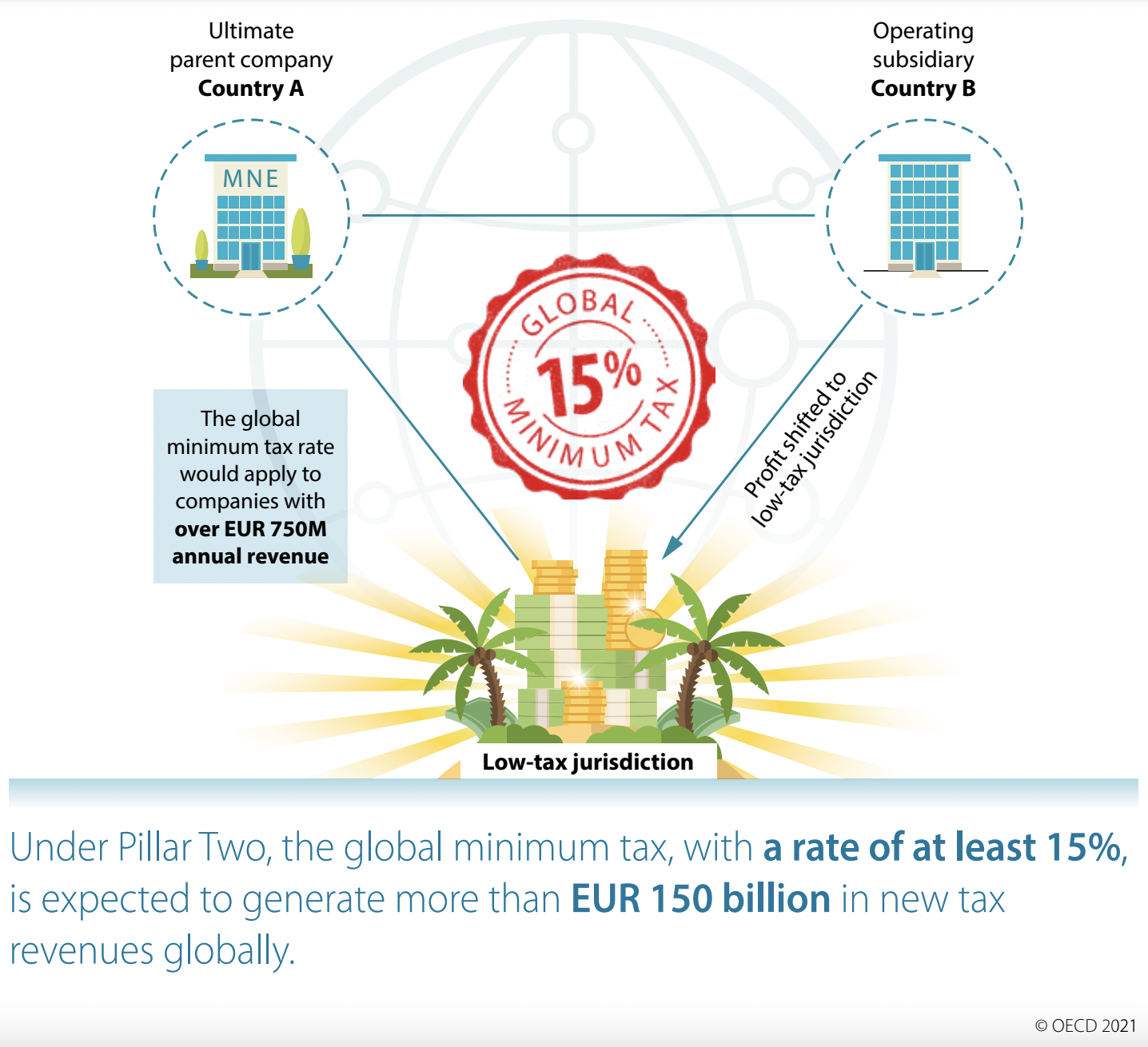

One of the primary strategies employed by the EU in navigating these tax treaties is the implementation of the OECD’s Base Erosion and Profit Shifting (BEPS) project recommendations. The BEPS initiative aims to prevent tax avoidance by multinational companies that exploit gaps and mismatches in tax rules. By incorporating these guidelines, EU member states are working towards a more coherent approach to taxing virtual businesses. This involves redefining the concept of permanent establishment to include significant digital presence, which allows countries to claim taxation rights based on the economic activity generated within their borders, even in the absence of a physical presence.

Moreover, the EU is exploring the introduction of a Digital Services Tax (DST) as an interim measure, while a more comprehensive international solution is developed. The DST would impose a levy on revenues generated from certain digital services provided within the EU, targeting activities that are currently under-taxed due to the limitations of existing tax treaties. Although the DST has faced criticism and concerns about its unilateral nature potentially leading to trade disputes, it represents a significant step towards adapting EU tax frameworks to the digital economy. By navigating these complex challenges, the EU aims to create a level playing field for all businesses operating within its jurisdiction.

Challenges and Solutions for Virtual Businesses

Virtual businesses face several challenges under current EU tax treaties, primarily due to the outdated nature of these agreements in addressing the nuances of digital operations. One major challenge is the determination of tax jurisdiction, which traditionally relies on physical presence as a determinant. For virtual businesses, which may operate entirely online, this criterion becomes obsolete, leading to potential tax avoidance and revenue loss for countries. This issue necessitates a rethinking of tax jurisdiction criteria to encompass digital footprints and economic presence, rather than just physical location.

Another challenge is the risk of double taxation or non-taxation, as virtual businesses often operate across multiple jurisdictions with varying tax rules. Without a unified approach, these businesses may find themselves taxed multiple times for the same revenue stream or, conversely, not taxed at all in any jurisdiction. The EU’s efforts to implement the OECD’s BEPS recommendations and to redefine permanent establishment criteria are crucial steps in mitigating these risks. By establishing clear guidelines and fostering international cooperation, the EU aims to reduce the complexity and uncertainty faced by virtual businesses in complying with tax obligations.

To address these challenges, the EU is also focusing on enhancing information sharing and cooperation among member states. This involves the exchange of data on digital transactions and the implementation of advanced technologies such as blockchain to ensure transparency and traceability in financial operations. By fostering a collaborative environment and leveraging technological advancements, the EU seeks to build a robust tax infrastructure that can effectively address the unique challenges posed by virtual businesses. These solutions not only aim to protect the tax base but also to promote fair competition and innovation within the digital economy.

The rapid expansion of virtual businesses in the digital age presents unprecedented challenges for traditional tax systems. The European Union, aware of the need to modernize its tax treaties, is actively working towards solutions that address the complexities of taxing digital enterprises. By redefining tax jurisdiction criteria, implementing OECD guidelines, and exploring new taxation measures like the Digital Services Tax, the EU is taking significant steps to ensure a fair and equitable tax environment. As the digital economy continues to evolve, ongoing collaboration and innovation will be crucial in developing sustainable tax frameworks that support both economic growth and fiscal responsibility.