In recent years, consulting firms have increasingly come under the spotlight for their role in advising multinational corporations on aggressive tax planning strategies. Despite heightened awareness and regulatory efforts, many of these firms have managed to avoid significant scrutiny. This article explores how consulting firms are navigating regulatory landscapes in the European Union (EU) and the challenges the EU faces in effectively regulating these practices.

Consulting Firms Dodge Scrutiny in Aggressive Tax Planning

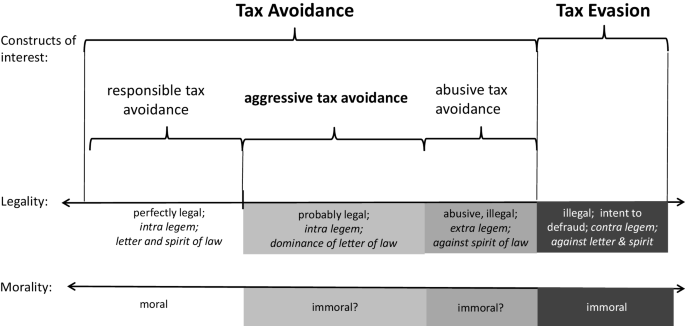

Consulting firms have mastered the art of skirting regulatory oversight by leveraging a combination of legal expertise, sophisticated financial instruments, and cross–border operations. By exploiting loopholes in international tax laws, these firms craft strategies that minimize tax liabilities while remaining technically within legal boundaries. This intricate dance allows them to offer lucrative tax-saving solutions to their clients without drawing significant attention from regulatory bodies.

One of the key tactics employed by consulting firms is the use of shell companies and complex corporate structures. These entities are often set up in jurisdictions with favorable tax regimes, creating a labyrinthine network that obscures the true nature of financial transactions. This opacity makes it difficult for tax authorities to trace the flow of money and identify potential abuses, thereby enabling firms to operate with relative impunity.

Moreover, consulting firms often invest heavily in lobbying efforts to influence tax legislation and policy. By maintaining close relationships with policymakers and participating in industry forums, they can shape the regulatory environment to their advantage. This proactive approach not only helps them stay ahead of potential regulatory changes but also ensures that any new laws or regulations are favorable to their business models.

EU Faces Challenges in Regulating Tax Advisory Practices

The European Union faces a myriad of challenges in its efforts to regulate aggressive tax planning practices. One of the primary obstacles is the lack of harmonization among member states’ tax laws. While the EU has made strides towards greater tax cooperation, significant disparities remain, allowing consulting firms to exploit these differences to their advantage. This fragmentation makes it difficult to implement a cohesive regulatory framework that can effectively address cross-border tax avoidance.

Another challenge is the limited resources and capacity of tax authorities to monitor and enforce compliance. Aggressive tax planning strategies often involve highly complex financial arrangements that require specialized knowledge and expertise to unravel. Many tax authorities are simply not equipped to deal with the sophistication and scale of these schemes, leading to a significant enforcement gap. This lack of capacity is further exacerbated by the global nature of many consulting firms, which operate across multiple jurisdictions and complicate enforcement efforts.

Finally, there is the issue of political will. While there is growing public and political pressure to tackle tax avoidance, concrete action often faces resistance from powerful corporate interests and their allies. Efforts to introduce more stringent regulations are frequently met with lobbying and legal challenges, slowing down the legislative process and diluting the effectiveness of any measures that are eventually adopted. This persistent pushback underscores the need for a more concerted and unified approach to regulating tax advisory practices within the EU.

The intricate web of aggressive tax planning strategies crafted by consulting firms presents a significant challenge for regulators in the European Union. Despite the best efforts of tax authorities and policymakers, these firms continue to find ways to avoid scrutiny and exploit legal loopholes. Addressing this issue will require a multifaceted approach, including greater harmonization of tax laws, increased resources for enforcement, and a stronger political commitment to tackling tax avoidance. Only through a coordinated and comprehensive effort can the EU hope to effectively regulate the practices of consulting firms and ensure a fairer tax system for all.