Italy’s tax system is known for its complexity, and tax audits are a critical component of ensuring compliance. Understanding the legal implications and preparing effective defense strategies are essential for individuals and businesses facing an audit. This article delves into the key legal consequences of tax audits in Italy and offers insights into robust defense mechanisms to navigate these challenging situations.

Navigating Tax Audits in Italy: Key Legal Implications

Tax audits in Italy are conducted by the Agenzia delle Entrate (Italian Revenue Agency) to ensure that taxpayers comply with national tax laws. The process can be initiated randomly or triggered by specific red flags in a taxpayer‘s financial records. One critical legal implication of a tax audit is the potential for substantial fines and penalties. These can range from administrative penalties for minor discrepancies to severe financial sanctions for more significant violations, including tax evasion.

Another significant legal consequence is the possibility of criminal charges. If the audit uncovers evidence of intentional tax evasion or fraud, the case may be referred to the public prosecutor’s office. This can lead to criminal investigations and prosecutions, resulting in severe penalties such as imprisonment. Therefore, the stakes in a tax audit are high, necessitating careful attention to detail and legal compliance.

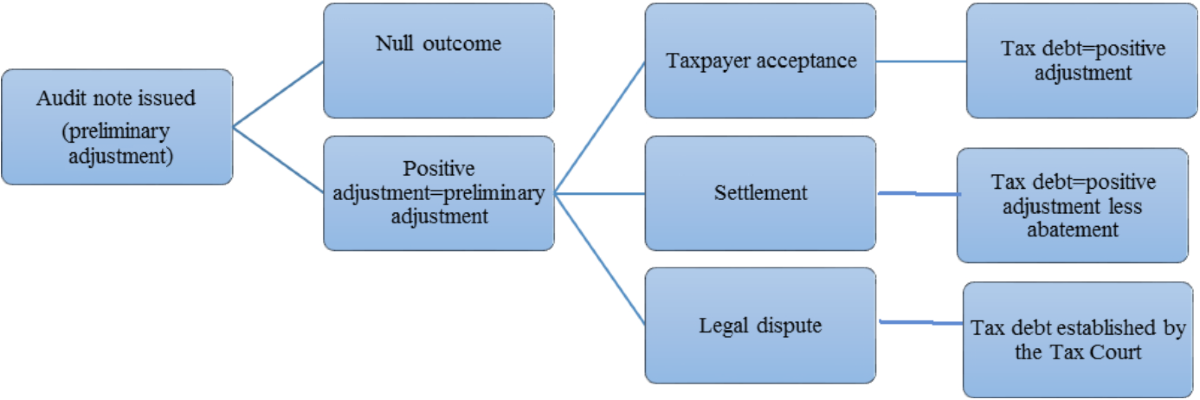

Moreover, tax audits can lead to prolonged legal battles. Disputes over audit findings may require appeals to tax courts, which can be time-consuming and costly. Taxpayers may need to engage legal counsel to navigate these proceedings, adding another layer of complexity to the audit process. Understanding these potential legal consequences underscores the importance of thorough preparation and knowledgeable representation during a tax audit in Italy.

Effective Defense Strategies Against Italian Tax Audits

One of the most effective defense strategies against a tax audit in Italy is meticulous record-keeping. Maintaining comprehensive and accurate financial records can provide a solid foundation for defending against audit findings. This includes keeping receipts, invoices, bank statements, and other relevant documents organized and readily accessible. Detailed records can help demonstrate compliance with tax laws and refute any allegations of discrepancies or irregularities.

Engaging a qualified tax advisor or legal expert is another crucial strategy. These professionals can offer invaluable guidance throughout the audit process, from initial preparation to final resolution. They can help identify potential issues before they escalate, advise on the best course of action, and represent the taxpayer in discussions with the tax authorities. Their expertise can significantly enhance the chances of a favorable outcome.

Lastly, proactive communication with the tax authorities can be beneficial. Responding promptly and transparently to audit inquiries can help build a cooperative relationship with the auditors. Providing clear explanations and additional documentation as requested can demonstrate a willingness to comply and potentially mitigate the severity of any penalties. While an adversarial approach may seem tempting, collaboration and openness often yield better results in the long run.

Facing a tax audit in Italy can be a daunting experience, but understanding the legal implications and implementing effective defense strategies can make a significant difference. By maintaining meticulous records, seeking expert advice, and engaging proactively with tax authorities, taxpayers can navigate the audit process more confidently and potentially avoid severe legal consequences. As the Italian tax system continues to evolve, staying informed and prepared remains essential for ensuring compliance and safeguarding one’s financial well-being.