The European Union Parliament is pressing forward with a significant overhaul of banking regulations, aiming to enhance financial stability and promote sustainable economic growth. The proposed changes, encapsulated in the New Capital Requirements Directive (CRD), are set to reshape the landscape of European banking. This article delves into the motivations behind these reforms and their anticipated impacts on the financial sector.

EU Parliament Advocates for Major Banking Reforms

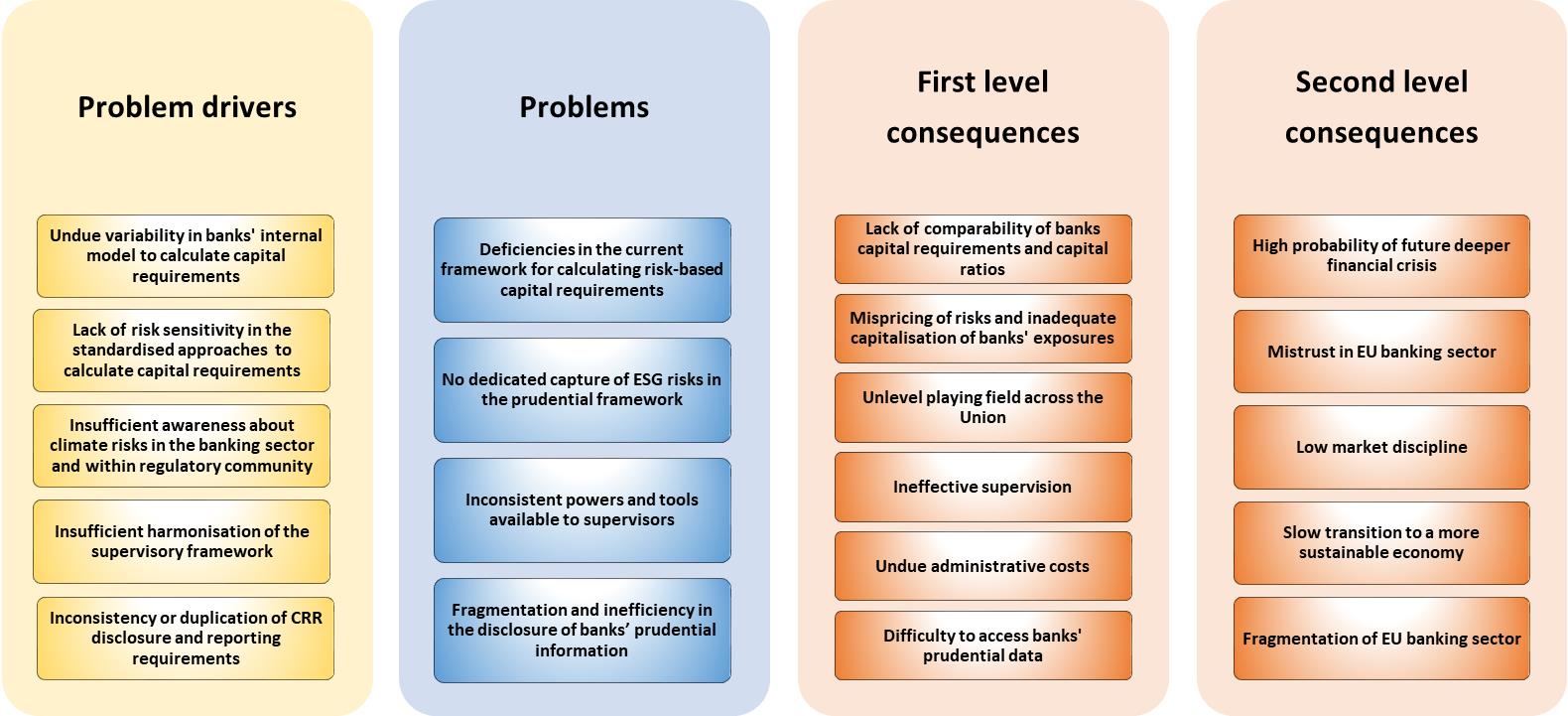

In a decisive move, the European Parliament has called for comprehensive reforms to the current banking regulatory framework. The push for change is driven by the need to address vulnerabilities exposed by recent financial crises and to fortify the banking sector against future shocks. Lawmakers argue that the existing regulations, while robust, require modernization to keep pace with evolving financial markets and emerging risks.

The New Capital Requirements Directive represents a cornerstone of this regulatory overhaul. It aims to tighten capital adequacy standards, ensuring that banks maintain sufficient capital buffers to absorb losses during economic downturns. By mandating higher capital reserves, the directive seeks to mitigate the risk of bank failures and reduce the likelihood of taxpayer-funded bailouts.

Moreover, the directive is designed to harmonize regulatory practices across EU member states, fostering a more integrated and resilient banking union. This harmonization is expected to eliminate regulatory arbitrage, where banks exploit differences in national regulations to minimize capital requirements. By creating a level playing field, the EU Parliament hopes to enhance the overall stability and competitiveness of the European banking sector.

New Capital Requirements to Bolster Financial Stability

The introduction of stricter capital requirements is a pivotal aspect of the New Capital Requirements Directive. Banks will be required to hold a higher proportion of their assets in the form of high-quality capital, such as common equity tier 1 (CET1) capital. This measure is intended to ensure that banks have a solid financial cushion to withstand periods of economic stress, thereby enhancing their resilience.

In addition to higher capital ratios, the directive includes provisions for countercyclical capital buffers. These buffers are designed to be built up during periods of economic growth and drawn down during downturns, providing banks with the flexibility to continue lending even in adverse conditions. By smoothing out the credit cycle, the EU Parliament aims to prevent the boom-and-bust dynamics that have historically destabilized the financial system.

The directive also emphasizes the importance of liquidity management. Banks will be required to maintain adequate levels of liquid assets to meet short-term obligations, reducing the risk of liquidity crises. Enhanced transparency and reporting requirements will further strengthen oversight and ensure that regulators can swiftly identify and address emerging risks. Collectively, these measures are expected to fortify the financial system, safeguarding it against future crises and promoting long-term stability.

The EU Parliament’s push for a banking regulatory overhaul through the New Capital Requirements Directive marks a significant stride towards a more resilient and stable financial system. By tightening capital and liquidity standards, and promoting regulatory harmonization, these reforms aim to protect the economy from future financial shocks while fostering sustainable growth. As the directive moves closer to implementation, its impact on the European banking sector will be closely monitored, with the hope that it will usher in a new era of financial stability and prosperity.