In an era where the digital economy is flourishing, the European Union (EU) has turned its attention to the persistent issue of corporate tax avoidance. With multinational corporations exploiting loopholes to shift profits and minimize tax liabilities, the EU is stepping up its efforts to ensure fair taxation. The introduction of a new framework marks a significant move towards combating tax evasion and profit shifting. This article explores the EU’s latest measures and their potential impact on the digital economy.

EU Targets Corporate Tax Evasion in Digital Economy

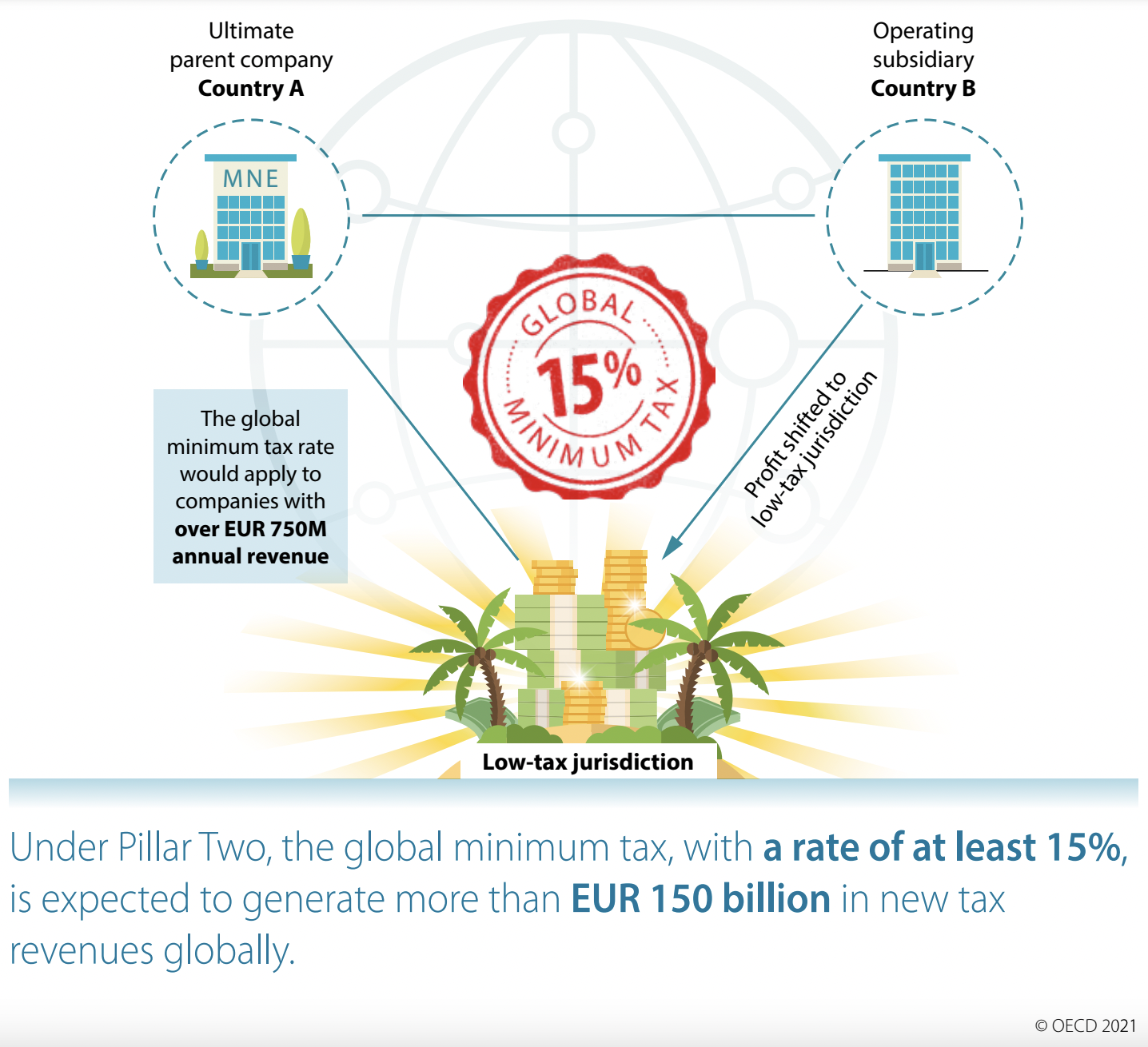

The digital economy has revolutionized business operations, but it has also created new avenues for tax avoidance. Multinational corporations often leverage complex structures and digital platforms to shift profits to low-tax jurisdictions, thereby reducing their tax burden. This practice, known as Base Erosion and Profit Shifting (BEPS), has been a growing concern for the EU, which estimates that it loses billions of euros in tax revenues annually due to such activities.

Recognizing the urgent need to address this issue, the EU has intensified its efforts to clamp down on tax avoidance in the digital sector. The European Commission has been working closely with member states to develop robust strategies that can effectively tackle BEPS. These strategies aim to ensure that companies pay taxes where they generate profits, thereby creating a level playing field for all businesses operating within the EU.

The EU’s focus on the digital economy is particularly pertinent given the rapid growth of tech giants who have mastered the art of tax optimization. By targeting corporate tax evasion in this sector, the EU aims to protect its tax base, promote fairness, and enhance the integrity of its tax systems. The new measures are designed not only to curb existing tax avoidance practices but also to anticipate and mitigate future challenges posed by the evolving digital landscape.

New Framework to Combat Profit Shifting Unveiled

In a landmark move, the EU has unveiled a comprehensive framework aimed at curbing profit shifting and ensuring that digital businesses contribute their fair share of taxes. This framework introduces several key measures, including the implementation of a minimum effective tax rate and enhanced transparency requirements for multinational enterprises. By setting a minimum tax rate, the EU seeks to eliminate the incentive for companies to shift profits to low-tax jurisdictions.

One of the cornerstone components of the new framework is the introduction of country-by-country reporting. This measure requires multinational corporations to disclose detailed financial information for each country in which they operate. Such transparency is expected to make it more difficult for companies to engage in profit shifting, as tax authorities will have greater visibility into their operations and financial flows. This increased scrutiny is anticipated to deter aggressive tax planning strategies and ensure that taxes are paid where economic activities occur.

Additionally, the framework includes provisions to strengthen cooperation between EU member states and enhance the exchange of tax-related information. By fostering greater collaboration, the EU aims to create a unified front against tax evasion and profit shifting. This collective approach is expected to not only improve tax compliance but also restore public trust in the fairness and effectiveness of the tax system. The EU’s new framework represents a significant step forward in the fight against corporate tax avoidance, particularly in the rapidly evolving digital economy.

The EU’s commitment to tackling corporate tax avoidance in the digital economy is a testament to its dedication to fair and equitable taxation. The new framework, with its emphasis on transparency, cooperation, and a minimum effective tax rate, seeks to close loopholes and ensure that multinational corporations contribute their fair share. As the digital landscape continues to evolve, these measures will play a crucial role in safeguarding the EU’s tax revenues and promoting a level playing field for all businesses. The success of this initiative will depend on the continued collaboration and vigilance of member states, as they work together to combat tax evasion and profit shifting in the digital age.