Personal income taxes are a crucial component of a nation’s fiscal policy, significantly influencing economic behavior, disposable income, and overall living standards. In the European Union (EU), where economic integration is a core objective, understanding the personal income tax landscape across member states is essential for evaluating economic competitiveness and social equity. This article delves into the personal income tax systems of various EU countries, providing a comparative analysis of tax rates and structures to uncover the similarities and differences that shape the economic fabric of the region.

Analyzing Personal Income Taxes Across EU Nations

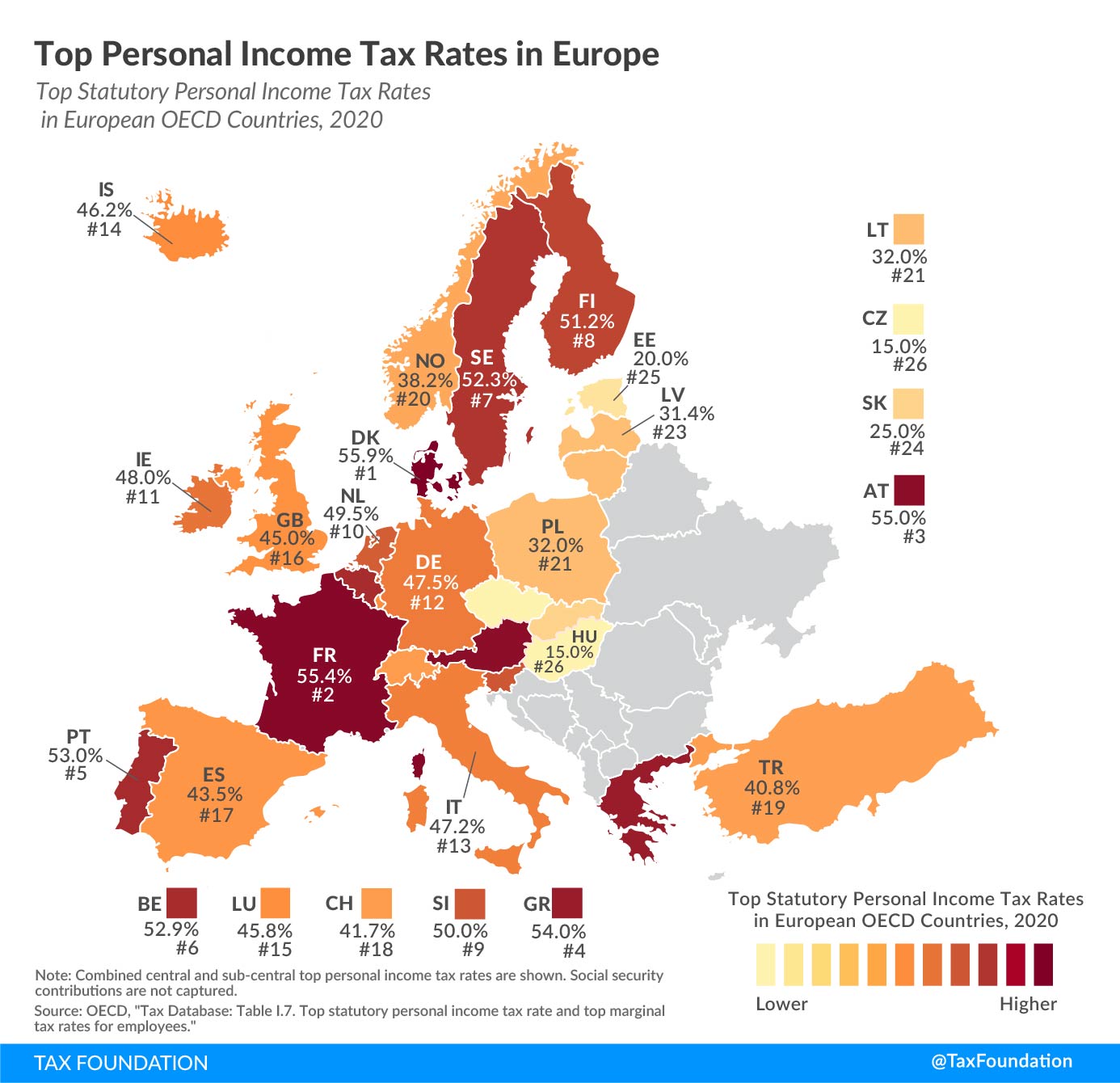

Personal income tax systems in the EU vary widely, reflecting each country’s unique economic priorities, social policies, and historical context. For instance, Scandinavian countries like Sweden and Denmark are known for their high tax rates, which fund comprehensive welfare programs and public services. In contrast, Eastern European countries such as Bulgaria and Romania have adopted flat tax systems with comparatively low rates, aiming to attract investment and stimulate economic growth. These differences highlight the diverse approaches EU nations take in balancing revenue generation with economic incentives.

Tax brackets and progressive taxation are common features in many EU countries, but the specifics can differ greatly. Germany, for example, employs a highly progressive tax system with multiple brackets, where higher income earners pay a significantly higher percentage of their income in taxes compared to lower earners. On the other hand, the Czech Republic’s flat tax rate of 15% simplifies the tax process but raises questions about equity and the distribution of the tax burden. These variations illustrate the broader debate between progressive and flat tax systems and their respective implications for income equality and economic efficiency.

Moreover, tax deductions and credits play a pivotal role in shaping the effective tax rates across EU member states. Countries like France offer numerous deductions for families, housing, and education, which can substantially reduce the tax liability for many taxpayers. Conversely, nations with fewer deductions, such as Estonia, focus on maintaining a simpler tax code. The presence or absence of these tax benefits can significantly affect taxpayers’ net incomes and, consequently, their economic behavior and quality of life.

A Comparative Study of Tax Rates and Structures

When comparing personal income tax rates across the EU, one observes a spectrum from low to high tax jurisdictions. Ireland, for example, has a relatively low top marginal tax rate of around 40%, which is designed to attract skilled labor and multinational corporations. In stark contrast, Belgium imposes one of the highest top marginal tax rates in the EU at 50%, reflecting its commitment to extensive social services and redistribution policies. This disparity in tax rates underscores the differing fiscal strategies and social contracts within the EU.

Structural differences in tax systems also manifest in the treatment of various income sources. In Italy, income from employment, capital gains, and dividends are taxed differently, with separate rates and exemptions. This contrasts with countries like Hungary, where a flat tax rate applies uniformly across different types of income. The differentiation or uniformity in taxing income sources can influence investment decisions and labor market participation, thereby impacting overall economic performance.

Additionally, the integration of social security contributions with income tax systems varies across EU nations. In Spain, social security contributions are a significant component of the overall tax burden on individuals, often leading to a higher effective tax rate than the nominal income tax rate would suggest. Meanwhile, in the Netherlands, social security contributions are more integrated into the income tax system, providing a clearer picture of the total tax burden. These structural nuances are crucial for understanding the real impact of personal income taxes on individuals and the economy.

In conclusion, the landscape of personal income taxes across EU member states is marked by significant diversity in tax rates, structures, and policy objectives. From the high-tax, welfare-oriented systems of Northern Europe to the low-tax, investment-friendly regimes of Eastern Europe, each country’s approach reflects its unique socioeconomic priorities. These differences not only affect the disposable incomes and economic behaviors of citizens but also play a crucial role in shaping the broader economic environment within the EU. As the EU continues to strive for economic cohesion and integration, understanding and comparing these tax systems remains vital for policymakers, businesses, and citizens alike.